If you’ve shown any interest in cryptocurrency investments, you surely know about the big dogs like Bitcoin and Ether. But with those coins trading over $55,000 and $4,500, respectively, it may be difficult for you to invest in them currently, especially if you have a limited budget.

So, the question is, what cryptocurrencies are the next Bitcoin or Ether? Luckily, there are more than 12,000 cryptocurrencies, and many of them are still trading for less than a dollar. Still, it can be challenging to decide which coins you want to invest in due to the plethora of optioins.

But if you make a good choice, these cheaper cryptos (or penny cryptocurrencies as they’re widely known) have the potential to return 10x – 100x on your initial investment. That’s why, in this article, we’re going to break down what’s the best penny cryptocurrency to invest in 2021.

While penny cryptocurrencies offer a greater potential return, they also carry more risk. Keep this in mind as you invest. And keep reading to learn the best penny cryptocurrency to invest in 2021.

What are Penny Cryptocurrencies?

Penny cryptocurrencies, as mentioned above, are digital currencies you can buy for less than $1. As cheap assets, they’re a similar type of investment as penny stocks. The primary advantage of penny cryptos, as with penny stocks, is the potential for high profitability.

Advantages of Penny Cryptos?

Here are three reasons why you should consider investing in penny cryptocurrencies:

- High Risk-Reward Ratios – many penny cryptos are undervalued. And, given the potential of blockchain technology, you can reasonably expect the value of these assets to rise in the near future.

- Investment Diversification – As with a traditional investment portfolio, you’ll want to diversify your crypto portfolio to generate consistent returns. If you invest in multiple kinds of coins, it offsets potential crashes fromone.

- Passive Income Potential – Per investment analysts, the best-paying dividend cryptos are primarily valued under $1. And, just like stock dividends, cryptocurrencies will pay dividends to investors for just holding penny crypto.

Disadvantages of Penny Cryptos?

As previously stated, it’s vital to understand investing in penny cryptocurrencies is an inherently more volatile proposition. Here are three factors you should understand that make penny cryptos riskier:

- Information (Or Lack Thereof) – Privacy is a central tenet of the cryptocurrency industry. As such, many developers are anonymous or hidden behind pseudonyms. Plus, given this anonymity, projects can skip audits or security checks.

- Liquidity – In 2021, the crypto market saw a bull run. This influx of cash and interest also brought a rise in projects whose value was artificially inflated through manipulation like “pump and dump” schemes.

- Scams/Rug Pulls – A rug pull is a phrase used to describe when a founder drains a investors’ money from a project then abandons it. Such scams aren’t uncommon among penny cryptocurrencies, so it’s essential to know as much about a project as possible before you invest.

What’s the Best Penny Cryptocurrency to Invest in 2021?

There’s no one best penny cryptocurrency to invest in 2021. So, we’ll give you several options, take a look and decide what’s best for you.

1.) Holo (HOT)

Holo is a distributed cloud hosting marketplace for P2P applications. Essentially, Holo is to cloud hosting what Airbnb was to hotels – anyone can become a host by turning their computer into a source of revenue. And you get paid for hosting peer-to-peer applications. Plus, by hosting these P2P apps, you support a web that empowers your peers and communities.

The platform supports three primary players: App Publishers, Hosts, and App Users. App publishers pay Hosts in HoloFuel to rent their extra data storage and compute power. App Users are served distributed apps from the Hosts. Together, through this ecosystem, users own their identities, control their data, and build the economies they want. HOT is an ERC-20 token that powers the Holo platform. This year HOT has seen a price increase of 1900%.

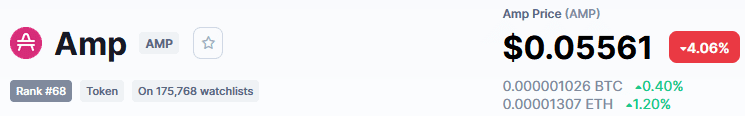

2.) Amp (AMP)

Amp is a universal collateral token. It’s designed to facilitate faster and more efficient transfers for any real-world application. When you use Amp as collateral, any transfers of value are guaranteed and can settle instantly. So, there’s no more push and pull between speed and security.

Amp provides speed without compromising security by serving as collateral for asset transfers. In other words, Amp allows you to use any asset immediately upon transfer, whether digital or physical. In 2021, the price of AMP has already increased by over 10,000%.

3.) Chiliz (CHZ)

Chiliz is the blockchain protocol behind the Socios.com engagement platform. Socios allows fans to purchase branded fan tokens from some of the world’s most significant and renowned sports teams. Now, Socios.com is the largest non-exchange blockchain-powered app in the world. And this platform uses Chiliz’s governance token – CHZ – as its exclusive on-platform currency.

You can use CHZ to purchase Fan Tokens on Socios. These fan tokens allow you to influence your favorite teams via popular vote. Plus, you become eligible for engagement-based team rewards and recognition. This year, CHZ has already increased more than 2,000%.

4.) Stellar (XLM)

Stellar is a protocol focused on facilitating remittances, international payments, and micropayments. It is maintained by the non-profit organization, the Stellar Development Foundation (SDF). They aim to create equitable access to the global financial system.

XLM is Stellar’s native token. So, Stellar users can XLM to send money internationally quickly and inexpensively. Additionally, XLM’s security makes it almost impossible to use for shady operations like money laundering. This security makes it more attractive for institutional investors, which is good for the long term. In 2021, XLM has already increased by over 138%.

5.) VeChain (VET)

VeChain is a blockchain-based supply chain platform that focuses on real-world problem-solving like cleaning bodies of water from plastics. Through VeChain, companies can benefit from improved efficiency, traceability, transparency, and reduced cost in their supply chain. Plus, VET has already demonstrated real return as it increased almost 1,500% between August 2020 and August 2021.

6.) The Graph (GRT)

The Graph is a DeFi protocol for organizing blockchain data and making it easily accessible. What Google does for Internet search, The Graph does for blockchains.

The Graph processes over 4 billion monthly queries for applications like Uniswap and GoinGecko. GRT is The Graph’s work token that powers the protocol’s ecosystem. GRT’s price has already grown by over 166% in 2021.

7.) Ravencoin (RVN)

Ravencoin built its platform for one specific function: to efficiently handle the transfer of assets from one party to another. Essentially, Ravencoin is designed to enable instant payments to anyone worldwide to verify the transfer of assets, such as crypto tokens. Over the last year, RVN has risen more than 512%.

8.) Ziliqa (ZIL)

Ziliqa is a public blockchain designed to solve one of crypto’s most significant problems – scalability. The protocol is used to create decentralized apps for staking and yield farming.

ZIL – its utility token – facilitates the use of smart contracts and helps process transactions on the network. In 2021, ZIL hasn’t seen as explosive growth as other tokens on this list. Still, the price of ZIL has steadily grown since its formation.

9.) Reserve Rights (RSR)

RSR is the native token of the Reserve Protocol. The Reserve Protocol is a stablecoin platform built on Ethereum. Unlike most other platforms on this list, RSR differentiates itself with a dual-token model.

In addition to RSR, the Reserve Protocol deploys RSV – a stablecoin that wraps three existing fiat-backed USD tokens. These tokens, as of now, are 1/3 USDC, 1/3 TUSD, and 1/3 PAX. In 2021, RSR has seen an increase in price of almost 72%.

10.) REEF Finance (REEF)

Reef Finance aims to simplify the sometimes-arduous process of trading, lending, and staking cryptocurrencies. The protocol does this through automation and aggregating liquidity. Additionally, as a Web3-built protocol, Reef combines the security of decentralized exchanges with the ease of use of centralized rivals.

Reef Finance’s native currency is REEF. This token is used for transaction fees and on-chain governance. In addition to having a say in the protocol’s governance, you can also stake REEF to earn further rewards. This year, the price of REEF has grown by nearly 100%.

11.) Hedera Hasgraph (HBAR)

Hedera is an enterprise-grade public network. This network is the only public ledger that uses hashgraph consensus. Hashgraph consensus is a faster, more secure alternative to blockchain consensus mechanisms. Hedera works to verify transactions while ensuring the highest standard of security.

HBAR is the native, energy-efficient coin of the Hedera network. HBAR works to power decentralized apps and transactions on the network and protect it from malicious actors. In 2021, HBAR’s price has grown by more than 900%.

12.) Gala (GALA)

Gala, or Gala Games, is a blockchain-based gaming company. Their primary mission is to make blockchain games people will want to play. And whatever you earn or win in a Gala game is yours. Your in-game items are verifiable assets on the blockchain you can trade or play with in-game.

GALA is the native token for all games in the Gala Games ecosystem. This coin is transferable between users, and you have complete control over how to use it. The price of GALA has exploded in 2021, seeing an increase of over 69,000%.

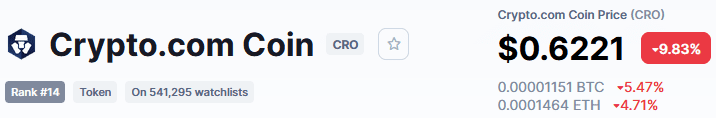

13.) Crypto.com Coin (CRO)

You’ve likely heard of Crypto.com from their recent splash in the promotional game. Beginning December 25th, 2021, the home of the Los Angeles Lakers, fka the Staples Center, will now be called the Crypto.com Arena thanks to a $700 million deal by the Web3 platform.

Crypto.com is a crypto wallet, exchange, and NFT marketplace in one. You can use CRO – the platform’s native token – for a multitude of actions within the protocol. This year, CRO has seen a price increase of more than 1,100%.

14.) Harmony (ONE)

Harmony is a quick and open blockchain that runs Ethereum apps with 2-second transaction finality and 1,000x lower fees than typical blockchains. Plus, users can perform cross-chain asset transfers with Ethereum, Binance, and three other chains via their secure bridge.

You can use your current Web3 wallet, like MetaMask, through this cross-chain interoperability but pay minimal fees. Any Ethereum wallets or portals can work with Harmony without code changes or a new install. ONE is Harmony’s native token. This coin has experienced wild growth this year. In 2021 alone, the price of ONE grew by over 6,100%.

15.) Polymath (POLY)

Polymath provides technology to create, issue, and manage digital securities on a blockchain. More than 200 tokens have already used Polymath’s Ethereum-based solutions to launch. Its mission is to build industry consistency for increased transparency, streamlined due diligence, and an improved user experience.

POLY is Polymath’s native token. Like other penny crypto tokens, POLY has experienced a robust price increase in 2021. This year, the price of POLY has grown by more than 750%.

P.S. If you want to get more DeFi analysis and news straight to your inbox, sign up for our newsletter here.