[ccpw id=”424″]

DeFi Strategy of the Week

In 2018, Uniswap’s v1 introduced its automated market maker (AMM). An AMM is a type of exchange where anyone can pool assets into share market making strategies. Two years later, in May 2020, Uniswap v2 introduced new features and optimizations.

Recently, in May 2021, Uniswap introduced v3. Uniswap built v3 to address current issues and make the platform more flexible and efficient. New features managed by Uniswap v3 include:

- Concentrated Liquidity

- Active Liquidity

- Range Orders

- Non-Fungible Liquidity

- Flexible Fees

- Advanced Oracles

- License

Theoretically, these improvements should allow Uniswap v3 to enable higher returns on capital for users and bring new possibilities for the developer community to build an ecosystem around the platform.

Of these features, concentrated liquidity and flexible fees are the platform’s two “new features.” Concentrated liquidity gives individual liquidity providers (LPs) more control over what price ranges their capital is allocated to.

Through v3, individual positions are aggregated together in a single pool. This single pool forms one combined curve for users to trade against. Similarly, new multiple fee tiers allow Uniswap v3 to compensate LPs for taking on varying degrees of risk appropriately.

Note, Uniswap has gained popularity over time thanks to its utilization of web 3.0 applications. Uniswap users can only interact with the protocol through a web 3 crypto wallet like Metamask. Web 3.0, originally called the Semantic Web, interconnects data in a decentralized way. Through Web 3 applications, data is interconnected in a decentralized manner designed to be more autonomous, intelligent, and open.

Web 3 products operate through decentralized peer-to-peer networks- the building blocks of blockchain and crypto technology. So, products and services that are web3 compatible, like Uniswap, can interact with smart contracts on the Ethereum blockchain.

You can watch a video explainer of Uniswap v3 here.

Yield Farm of the Week

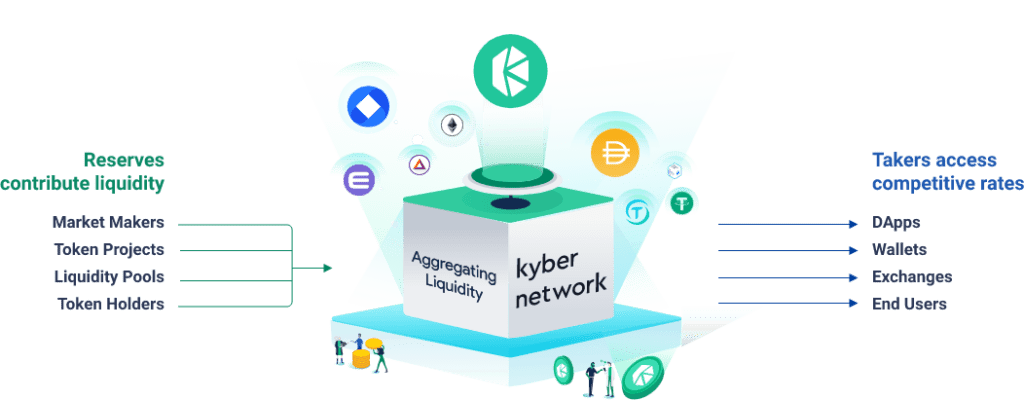

Kyber Network is an on-chain liquidity protocol that powers easy-to-manage token swaps in DeFi with high composability. Based on the Ethereum protocol, Kyber is designed to allow any party to contribute to a liquidity pool as Reserve Managers.

Their long-term goal is to support a diverse amount of emerging digital ecosystems by facilitating liquidity between different stakeholders in each ecosystem. By standardizing the protocol’s design, Kyber hopes to achieve a fully connected liquidity network across multiple different blockchains. This standardization would provide frictionless cross-chain token swaps.

Essentially, the Kyber network lets users instantly convert or exchange any cryptocurrency by keeping everything on the blockchain.

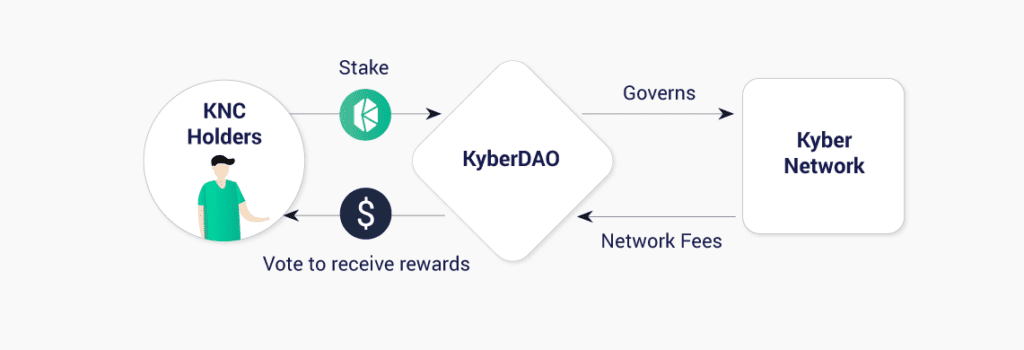

And yes, Kyber Network has a governing token. This token, KNC (Kyber Network Crystal), is managed through KyberDAO, a community DAO platform. This platform empowers KNC token holders to participate in the governance of the Kyber Network and helps align incentives between key stakeholders.

Here’s how Kyber creates value for KNC holders:

It’s also important to note that KNC is the first deflationary staking token. Because it’s a deflationary token, staking rewards and token burns are determined by the actual network and DeFi growth.

You can watch a KyberDAO Tutorial here.

News & Industry Update

1.) Morgan Creek Capital CEO: BTC Could Trade for $250K within 5 Years

The CEO of Morgan Creek Capital, Mark Yusko, believes Bitcoin’s next market cycle could see the asset trade for more than $200K.

2.) Over $1 Billion is Now Managed by DAOs

Fund managed by Decentralized Autonomous Organizations (DAOs) now exceed $1 billion. This sum marks an incredible increase from $10 million a year ago.

3.) Curve Finance Token Holders Reaping Rewards

During the last month, veCRV holders received news of upcoming airdrops from two separate projects.

4.) UBS Exploring Ways to Offer Crypto to Wealthy Clients

Swiss financial giant UBS Group is in the early stages of planning digital currency investment options for affluent clients.

5.) Google Search Interest in Dogecoin Outstrips Bitcoin for the First Time

For the first time, more people globally are searching for news surrounding the meme cryptocurrency Dogecoin than Bitcoin.