[ccpw id=”424″]

Protocol of the Week

Lien Finance is a DeFi protocol that issues a trustless stablecoin – iDOL – backed by cryptocurrency and pegged to a fiat currency. The supply of this stablecoin is managed by a smart contract deployed on the Ethereum network.

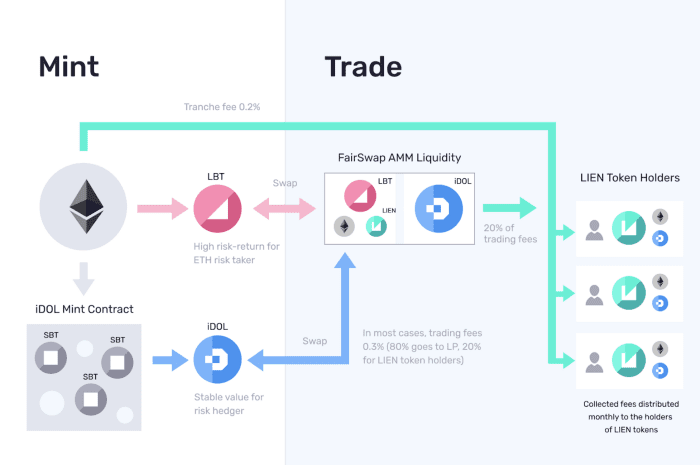

When creating iDOL, Lien splits ETH into two separate derivatives: a variable component and a stable component. This variable component is the Liquid Bond Token (LBT), while the stable component is the Stable Bond token (SBT). LIEN, the native token, governs the Lien Protocol.

DeFi Strategy of the Week

Utilizing Lien Finance to create Options and Stablecoins out of ETH.

The two primary derivatives that comprise Lien’s stablecoin (iDOL) both act differently based on their unique design. The LBT is built to absorb most of the volatility in the price of ETH:USD. Essentially, the LBT is a financial instrument that performs like a 2x leveraged call option on ETH.

The SBT, on the other hand, is stabilized against the U.S. dollar. This characteristic of the SBT makes it an ideal form of collateral for Lien’s iDOL. These two bond tokens are minted at the same time with the same price and maturity date.

So, instead of relying on over-collateralization, iDOL is backed by a basket of SBTs, each with its own maturity date. These characteristics place the majority of risk on those speculating on the value of LBTs. As previously stated, LBTs act as a 2x leveraged call option on ETH. Essentially, the value of LBTs is associated with Ether but fluctuates much more than Ether.

To get started on Lien, go to their app and connect your wallet. Or click here to learn more about Lien Finance and their trustless stablecoins.

Yield Farm of the Week

Farming through YFDAI Finance.

YFDAI Finance is a DeFi protocol built to help users securely borrow, lend, stake, and farm easily. The protocol provides a unique experience with audited smart contracts and a robust token lock system. YFDAI is governed through its native token: YF-DAI.

The farming pools of YFDAI Finance differ from other pools in that they require participants to provide liquidity to the Uniswap YF-DAI-ETH pair via the Uniswap pools. This liquidity, in turn, will give guaranteed returns paid from the Uniswap fees.

These rewards are calculated on a pro-rata basis. This basis means the more a participant deposits to the pool, the higher the participant’s percentage of the total rewards.

To get started farming YF-DAI, go to the farm page on YDFAI’s site and connect your wallet.

News & Industry Updates

1.) Here’s the Latest on How U.S. Regulators Want to Crack Down on Crypto

Top U.S. lawmakers are taking steps to tighten their grasp on cryptocurrencies or advocating for greater control over digital assets.

2.) Circle Says it Wants to Become a National Crypto Bank

Fresh on the heels of an announcement to go public, Circle said it intends to become “a full-reserve national commercial bank.”

3.) Price of Gold Crashes 6% in Two Hours

The price of gold swiftly crashed below $1,700 per ounce yesterday afternoon.

4.) KYC Tools can Minimize Hassle for U.S. Crypto Market, FTX CEO Says

Sam Bankman-Fried, CEO of FTX crypto exchange, believes added Know Your Customer (KYC) operations can help reduce the hassle of operating in the crypto space.

5.) Axie Infinity Becomes Ethereum’s First NFT Game to Hit $1 Billion in Sales

Last week, Axie Infinity, recently featured on Block_Life, became the first NFT game to cross $1 billion in sales.