[ccpw id=”424″]

Protocol of the Week

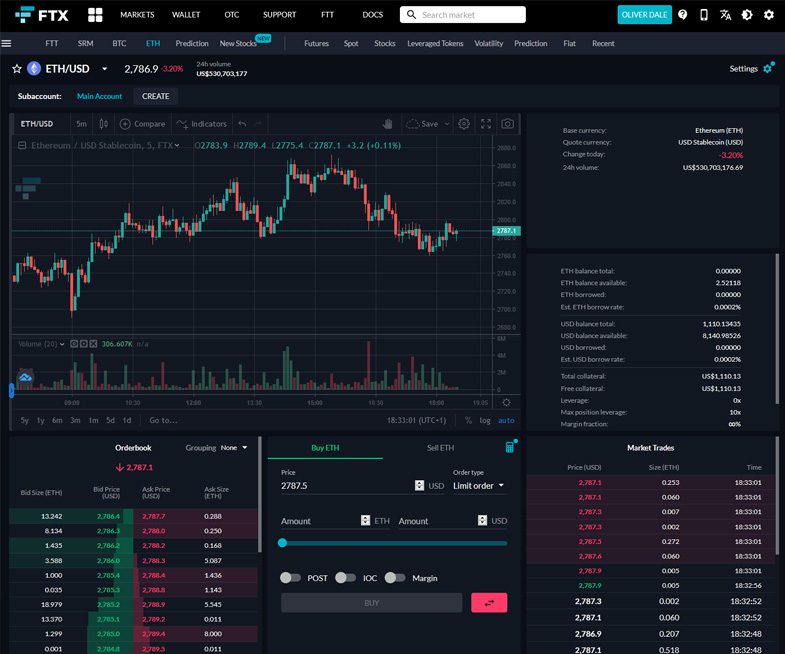

FTX Exchange.

FTX is a cryptocurrency derivatives exchange. They offer users futures, leveraged tokens, and OTC trading. Being a derivatives exchange means you can only trade derivatives, NOT real assets on FTX. Instead, you trade a derivative product that reflects the value of the underlying asset.

FTX’s wide variety of indices and leveraged tokens differentiate it from its competition. For example, FTX offers perpetual swaps for 15 assets – significantly more perpetual swap options than two of its competitors BitMEX and Deribit, provide.

FTX Exchange governs itself through its native token – FTT. In addition to being a tradable asset, FTT also grants holders multiple benefits. These benefits include lower trading fees, socialized gains via the FTT insurance fund, and the ability to use FTT as collateral for futures trading.

DeFi Strategy of the Week

Trading crypto derivatives through the FTX Exchange.

Through FTX, investors can trade several different types of crypto derivatives. We’ll detail a few of the most popular derivatives used on FTX below. Keep in mind these are just a sampling of the handful of derivatives available through FTX.

Futures

Futures are derivative instruments used to obligate two parties to trade an asset at a prearranged date and price. Using crypto futures allows traders to capitalize on the benefits of leverage. On FTX, you can apply leverage of up to 101x on most of the platform’s derivative contracts.

Currently, FTX offers future contracts for over 80 cryptocurrencies. This extensive menu of futures is far greater than the 13 crypto futures offered by competitor BitMEX. Additionally, FTX lets users trade Perpetual Futures. Perpetual futures are contracts that do not expire.

Options

Options are derivatives that are very similar to futures. The primary difference is that options give the contract holder the option but don’t mandate they purchase the underlying asset on expiry.

Rather, options give the contract holder the right, but not the obligation, to purchase the asset. Currently, FTX only offers Bitcoin options. You can design your own options contract and receive a quote within 10 seconds on the platform.

Leveraged Tokens

Leveraged Tokens are financial instruments unique to the FTX Exchange. These tokens are ERC20 assets that reflect the real-world price of the underlying digital currency. For example, BULLUSD is a 3x long BTC token. Being 3x long means that for every 1 percent BTC increases in a day, the instrument’s value increases by 3 percent.

Many of these leverage tokens automatically rebalance themselves throughout the day to maintain the asset’s target leverage. So, if you made a profit during a day, the tokens will automatically reinvest that money.

Or, if you lose money, your tokens will sell some of the position to reduce its leverage. This automatic rebalancing helps investors avoid liquidation risk while trading with leveraged coins. Plus, because this rebalancing is automated, it saves traders both time and effort.

Click here to learn about other crypto derivatives offered through FTX.

Yield Farm of the Week

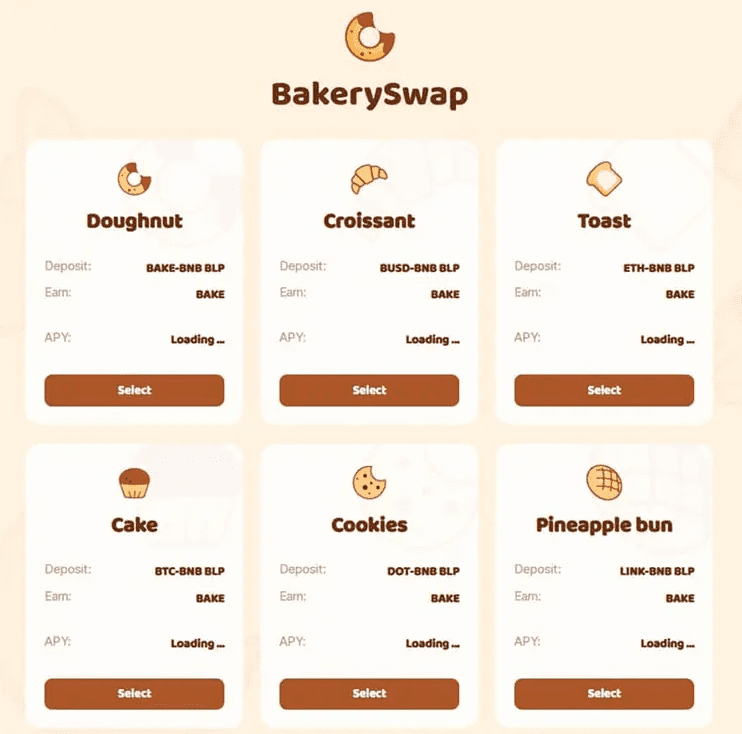

Farming via Bakery Swap.

Bakery Swap is an automated market maker (AMM) that utilizes the Binance Smart Chain. Unlike other AMMs, which use an order book, Bakery Swap utilizes a mathematical formula to price assets. According to Bakery Swap, using Binance Smart Chain allows for faster transactions with lower gas fees.

Bakery Swap supports its own NFTs and NFT marketplace, swaps, and our focus today, yield farming opportunities. Bakery Swap is governed by its native BakeryToken – BAKE.

You can begin yield farming via Bakery Swap through several different methods. The first method to earn rewards on Bakery Swap is by depositing your liquidity provider tokens in one of the Bakery Swap liquidity pools. By providing liquidity to these pools, you’ll earn both fees and Bakery Swap Liquidity Pool (BLP) tokens.

The second method is to stake your BLP tokens to earn BAKE or other limited-edition tokens. What you gain from staking your BLP depends on what pool you choose to stake your tokens in.

Additionally, you can earn even more BAKE by staking your existing BAKE tokens. You can stake any of your BAKE in the ‘Bread’ pool, which requires no minimum staking amount or any lock-up period.

Learn more about yield farming via Baker Swap here.

News & Industry Updates

1.) ‘Space Jam’ NFTs Launched by Warner Bros. and Nifty’s

The collection features LeBron James and eight Looney Tunes characters. It marks another attempt to capitalize on the NFT boom among more mainstream audiences.

2.) Here’s How to Stop Crypto Scams Forever

Through three simple steps, you can significantly reduce your chances of falling prey to a crypto scam.

3.) Fourth-Largest South Korean Bank to Roll Out Crypto Custody Services

Woori Financial Group has reportedly agreed to set up a digital asset custody joint venture with blockchain-based solutions provider Coinplug.

4.) 3 Reasons Why Constellation (DAG) Price Outperformed Most Altcoins this Week

A pivot toward DeFi, a new wallet release, and low transaction costs pushed DAG to a new all-time high.

5.) Circle to Go Public in Q4 at $4.5B Valuation

Circle, a USDC stablecoin issuer, recently announced plans to go public in Q4 of 2021. They will trade under the ticker symbol – CRCL. The company is currently value at $4.5B.