[ccpw id=”424″]

Protocol of the Week

dYdX Exchange

dYdX is a decentralized exchange that offers permissionless lending, margin capabilities, and the ability to swap between these assets off-chain without paying gas. Built on the Ethereum blockchain, dYdX aims to help crypto traders control risk or hedge their different positions.

DeFi Strategy of the Week

Using the dYdX Exchange to lend, swap, and more.

Through the dYdX Exchange, users deposit collateral to a non-custodial orderbook, so that orders can occur off-chain. The ability to process orders off-chain means you will only pay gas when depositing and withdrawing assets from dYdX.

And, while there is still a small transaction fee for every dYdX trade, you can place orders simply by signing a transaction through this system, rather than waiting to have it processed on the Ethereum network.

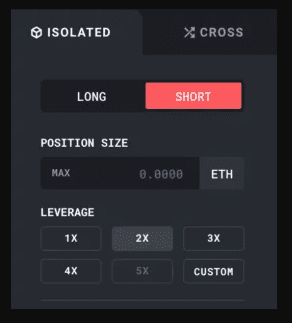

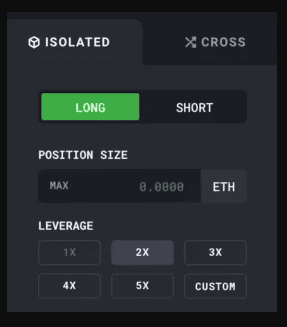

One aspect of dYdX that makes it unique is its approach to margin trading, utilizing both isolated and cross margin strategies. Margin trading allows users to take on increased exposure beyond the assets they currently own.

Isolate margin lets users leverage one specific asset. Cross margin, on the other hand, allows users to take out a position using all the assets in their account. You can invest in these margins via the “Margin” tab on the dYdX site and take out a leverage long or short position on ETH.

If you take out an Isolated long position, the trade is processed in ETH. Conversely, if you take out an Isolated short position, the trade is paid using DAI. Through Margins, users can select the amount of leverage they’d like in multiples of 100% – up to a total of 500% (or 5x).

Finally, after selecting your desired leverage, you can review the costs associated with your order, and how they will affect your current balances.

Learn more about how to trade margins and perpetuals or lend via dYdX here.

Yield Farm of the Week

Using Pendle Finance to trade tokenized future yield.

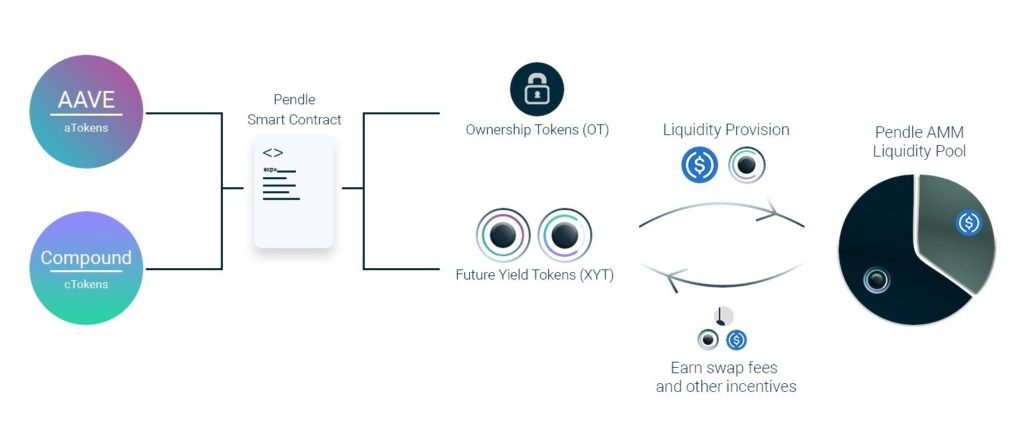

Pendle is the first DeFi protocol that allows you to trade tokenized future yield on an automated market maker (AMM) system. Through Pendle, holders of yield-generating assets can achieve additional yield and lock in future yield upfront. Similarly, the protocol offers traders exposure to future yield streams without the need for underlying collateral.

Pendle’s system is comprised of three primary components:

- Yield Tokenization

- Pendle’s AMM

- Governance

The main advantage of Pendle, for those with yield-generating assets, is the ability to deposit these yield-bearing tokens in Pendle to mint an Ownership Token (OT) and a Yield Token (YT). From there, Pendle users can utilize their YT in two different ways:

- By depositing their YT into Pendle’s AMMs to provide liquidity to Pendle. In return, these liquidity providers receive fees and other incentives from Pendle.

- By selling their YT for cash up front, which allows them to fix interest rates and immediately lock in returns.

Plus, traders can buy these YTs directly without the need to lock up their underlying assets. Not needing to lock up underlying assets gives traders a more capital-efficient means to gain exposure to future yield.

Connect your crypto wallet and begin minting, swapping, or providing liquidity via Pendle today.

News & Industry Updates

1.) Bitcoin Hashrate Falls 17% Overnight

Following a Bitcoin mining crackdown in China’s Sichuan province, Bitcoin’s hashrate fell 17% overnight. This decrease had a significant, negative impact on some of Bitcoin’s top mining pools.

2.) 4 Reasons why 5% Bitcoin Exposure is Difficult for Major Funds

Last week, legendary investor Paul Tudor Jones advocated for investors targeting a 5% Bitcoin portfolio allocation to help combat inflation. But here’s why that may be difficult to reach for major funds.

3.) Goldfinch Raises $11M to Bring Unsecured Loans to DeFi

Unsecured loans, a long-missing piece of the DeFi puzzle, may finally be coming to open finance, per Goldfinch.

4.) U.S. Government to Auction off Seized Litecoin and Bitcoin

The U.S. General Services Administration will auction off Bitcoin and Litecoin worth a combined market value of $377,000 it seized for nonpayment of internal revenue taxes.

5.) Post-Crash Prices Give Investors a Chance to Build a Diversified Portfolio

Looking to build a more diversified crypto portfolio? DeFi, stablecoins, and oracles are three cornerstone sectors you should consider.