Protocol of the Week

Terra

Terra is a public blockchain protocol. It uses a suite of decentralized algorithmic stablecoins that underpin a thriving ecosystem to bring DeFi to the most people possible. The protocol creates stablecoins to track the price of any fiat currency consistently.

Through these stablecoins, Terra users can spend, save, trade, or exchange stablecoins instantly on the Terra blockchain. Plus, through the protocol’s native token – LUNA – Terra users can stake it for additional rewards from transaction fees or use it for governance power.

Plus, the Terra network is continually expanding its network of decentralized applications. The larger the network becomes, the more the demand for Terra stabilizes. This stabilization ensures the price of LUNA will continue to grow.

The Terra protocol consists of two primary tokens: Terra and Luna.

- Terra – Terra are stablecoins that track the price of fiat currencies. Users mint new Terra by burning Luna. These stablecoins are named after their fiat counterparts. So, for example, TerraUSD or UST.

- LUNA – LUNA is the protocol’s native staking token. It helps to absorb the price volatility of Terra. As previously stated, you can use Luna for both governance and mining. So, the more people use Terra; the more LUNA is worth.

DeFi Strategy of the Week

Using the Terra Station to stake LUNA.

Today, we’ll focus on the benefits of having and staking LUNA. The arbitrage trading activity reducing price volatility for Terra stablecoins, like UST, creates transaction volume on the Terra blockchain.

So, every transaction creates value for LUNA stakers in three distinct ways:

- Gas Fees – While gas fees on Terra are slight, these fees are added to transactions and paid to LUNA stakers

- Tax Fees – These fees, ranging from 0.1 – 1 percent, are charged for every transaction and paid to LUNA stakers.

- Seigniorage – Creates rewards for validators. Profits are added to the community pool.

Once you have LUNA in your wallet, you can stake it from the Terra Station. Begin by clicking “Staking” on the left menu in the station.

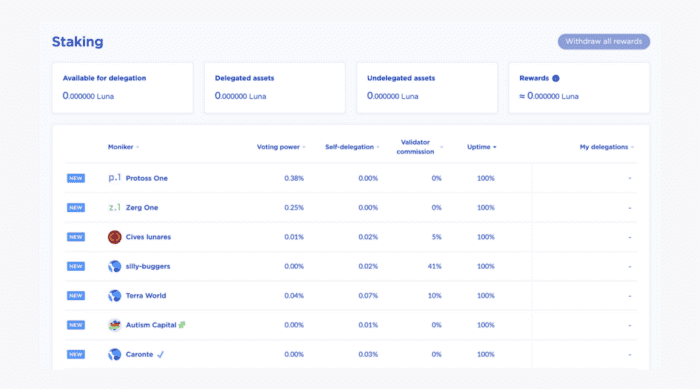

From here, a dashboard will open, which should resemble the one below.

If you have successfully added LUNA to your wallet, you’ll see it’s available for delegation at the top of your staking dashboard. You’ll also see a list of available validators. Select the validator of your choice by clicking on their name. The details of the validator should appear.

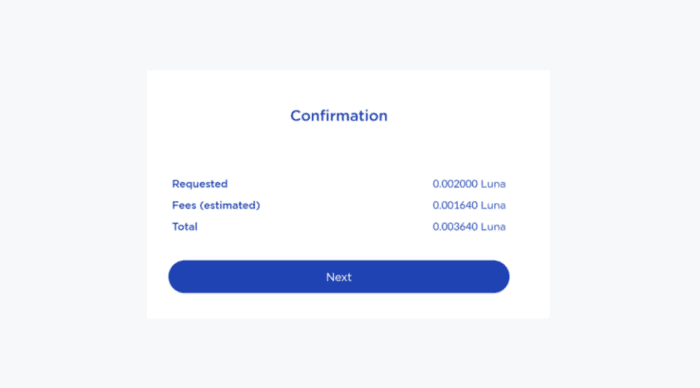

Then, click “Delegate” in the bottom left menu to stake your LUNA. A pop-up will appear asking you to double-check your wallet address and the address to which you’d like to delegate your LUNA. After, decide how much LUNA you’d like to delegate and click “Next.”

Again, double-check all the details. If everything is correct, click “Next.” Add your password the last time to confirm, and you’ll have successfully staked your LUNA!

Note: While LUNA is staked and generating rewards, you can’t freely trade it. To trade, you need to unbond your LUNA. The unbonding phase takes 21 days to complete.

Yield Farm of the Week

Yield farming with Iron Finance

Iron Finance is a multi-chain, decentralized ecosystem of DeFi products and protocols. Currently, Iron Finance is live on Polygon, Avalanche, and Fantom. Two of the primary protocols on Iron Finance are IronSwap and IronLend.

IronSwap is an automated market maker (AMM) protocol specialized for fast and efficient swapping of stable assets at ultra-low fees and near-zero slippage.

IronLend is an algorithmic money market system designed for a completely decentralized finance-based lending and credit system. This protocol allows depositors to earn passive income by providing liquidity to the market. At the same time, borrowers can use perpetual overcollateralized loans they can pay off in any amount, at any rate.

In addition to these protocols, the two primary products of Iron Finance are the IRON stablecoin and the ICE token. The IRON stablecoin is a partially-collateralized token that’s soft-pegged to the U.S. dollar and is available on both Polygon and the BSC. Essentially, IRON functions to minimize price volatility across Iron Finance’s ecosystem.

The ICE token is the utility token for the entire Iron Finance ecosystem. You can trade and farm ICE on DEXs across the Polygon network. If you stake ICE, you receive BlueICE in return. So, through staking, ICE becomes an interest-bearing asset with governance rights that accrues platform profits via USDC dividends.

Yield Farming ICE

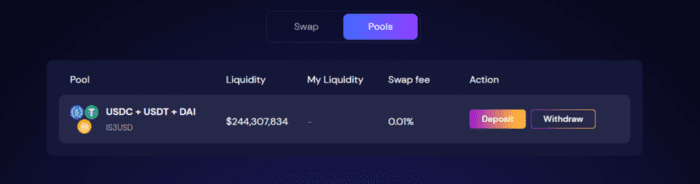

Here’s how you can begin earning awesome rewards by farming ICE on Terra. First, go to the “Swap” page and click on “Pools.”

Then click “Deposit.” Next, enter the amount of stablecoins you want to deposit, and click “Deposit.”

Then, go to the “Farms” page. Click into a pool you want to provide liquidity to, enter the amount to deposit, click “Deposit,” and sign the transaction.

From here, just sit back and wait as your tokens begin earning a yield in ICE.

News & Industry Updates

1.) NFTs More Popular Than Ever Despite Sour Mood in Wider Crypto Market

More people are taking to Google to search for NFTs than Bitcoin or any other crypto asset.

2.) Yearn Finance Changes Up its Tokenomics and YFI Soars 85%

Yearn, a yield aggregator recently introduced new tokenomics. Since this introduction, its token YFI has jumped more than 87 percent in a week.

3.) U.S. Goes to Court to Recover $154M Stolen from Sony, Converted to Bitcoin

The DOJ (Department of Justice) has filed a civil forfeiture complaint to return over $150 million stolen from Sony and subsequently converted to Bitcoin.

4.) Here’s Why Ethereum Traders Could Care Less About ETH’s Current Weakness

The price of ETH could hit new lows close to $3,600. Still, derivatives data has pro traders feeling bullish about the coin.

5.) Warren Calls for Clampdown on DeFi and Stablecoins ‘Before its Too Late’

Sen. Elizabeth Warren is calling for increased regulation on DeFi and Stablecoins. Per the former Harvard law professor, the reserve assets supporting the peg for top centralized stablecoins could be smoke and mirrors.