[ccpw id=”424″]

Protocol of the Week

Venus Protocol

Venus Protocol is an algorithmic-based money market system designed for the Binance Smart Chain (BSC). The protocol was built to bring a completely decentralized finance-based lending and a credit system for the BSC.

The primary difference between Venus and other money market protocols is Venus’ ability to use collateral supplied to the Venus market to borrow other assets and mint synthetic stablecoins. These stablecoins are not backed by a basket of fiat currencies but by a basket of cryptocurrencies.

Ensuring these synthetic stablecoins hold over-collateralized positions also works to protect the protocol. Similarly, because it utilizes the BSC, Venus can conduct fast, low-cost transactions all while accessing a deep network of wrapped tokens and liquidity.

Venus is governed through its native token – XVS.

DeFi Strategy of the Week

Harnessing the potential of borderless stablecoins through Venus Protocol.

As mentioned, through the Venus Protocol, crypto investors can: supply assets to earn interest, borrow assets, mint synthetic stablecoins – VAI, and farm XVS tokens. Today, we’ll focus primarily on using Venus to earn interest, minting synthetic VAI, and farming XVS.

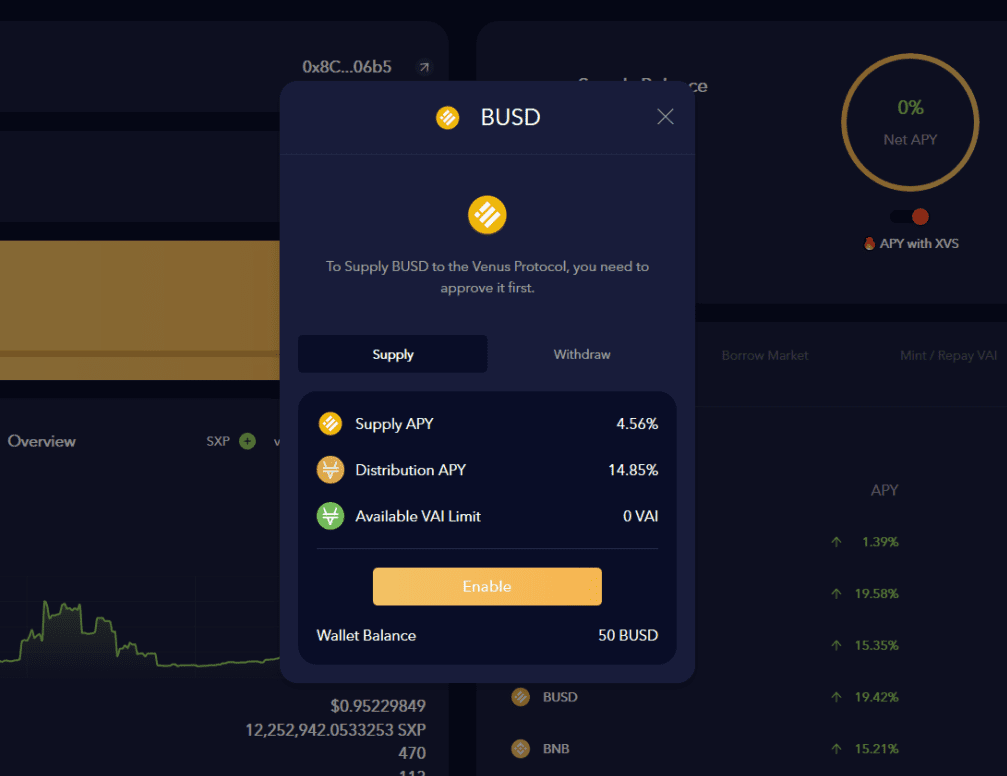

Earning Interest on Venus

Start by clicking on a given asset in the Supply markets. A new box will open when you click on a given market. From here, enable the asset you wish to supply. The protocol will ask you to confirm the transaction with your wallet, and there will be a small gas fee.

Once the transaction has been confirmed, you can set the amount you’d like to Supply. Assets are supplied immediately to the protocol, so you’ll immediately begin earning interest.

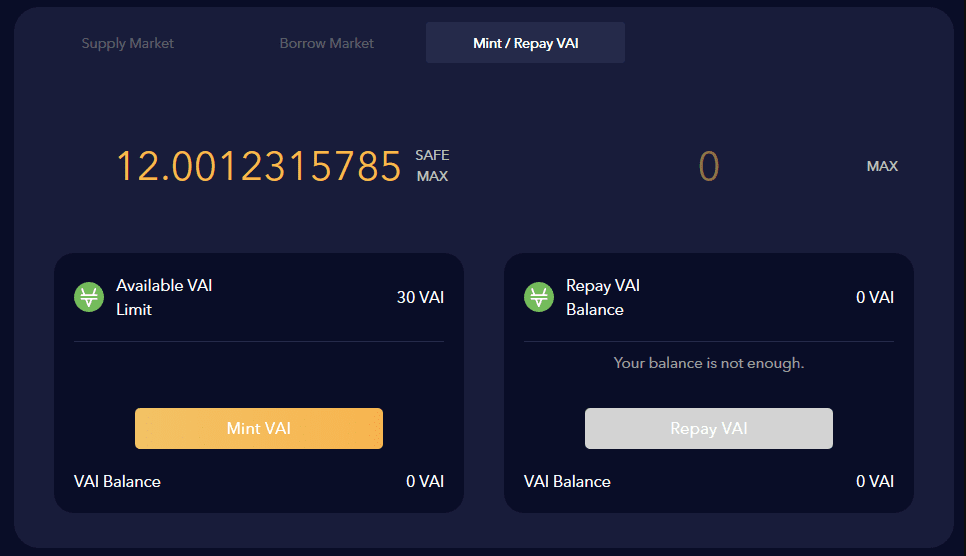

Minting VAI

To begin, open the “Mint/Repay VAI” tab. Then, set the amount you’d like to mint. To repay your VAI loan, you’ll need to enable the asset with the protocol. If you’re ready to repay your loan, set the amount and click “Repay VAI.” Note, the amount you can mint depends on your total supplied collateral.

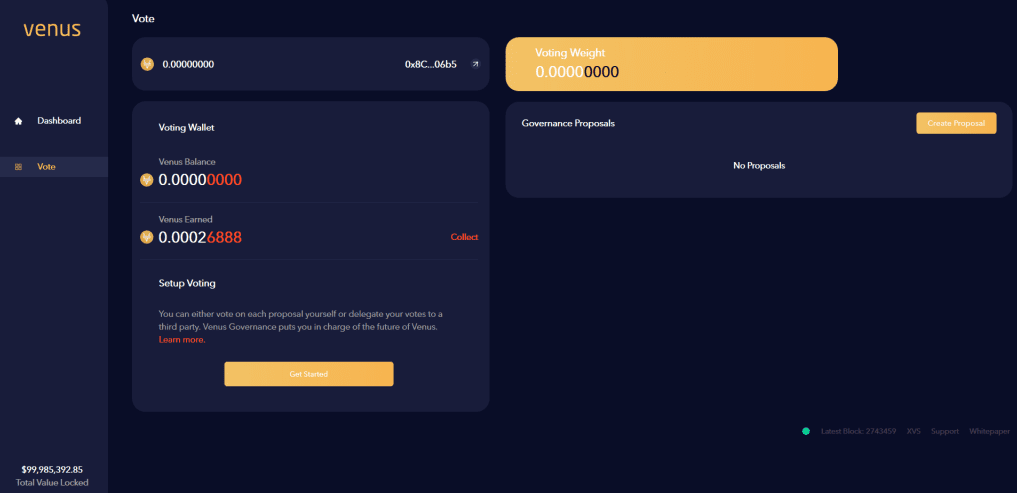

Farming XVS

Use the “Vote” tab to open the Venus Protocol governance dashboard. Here, you can check your XVS farming and claim any rewards. Click the “Collect” button next to your “Venus Earned” balance. To compound these rewards, you can invest your XVS with the XVS Supply Market.

Learn more about utilizing the full potential of the Venus Protocol here.

Yield Farm of the Week

ANY Yield Farming with Anyswap Pool.

Anyswap is a fully decentralized cross-chain swap protocol. The protocol is based on Fusion DCRM technology, which automates pricing and its liquidity system. Anyswap protocol’s first application is a decentralized exchange, the Anyswap Exchange.

Essentially, Anyswap enables users to swap between any coins on any blockchain that uses ECDSA or dDSA as its signature algorithm. Eligible tokens include BTC, ETH, USDT, XRP, LTC, FSN, and more. It’s native token, ANY governs Anyswap.

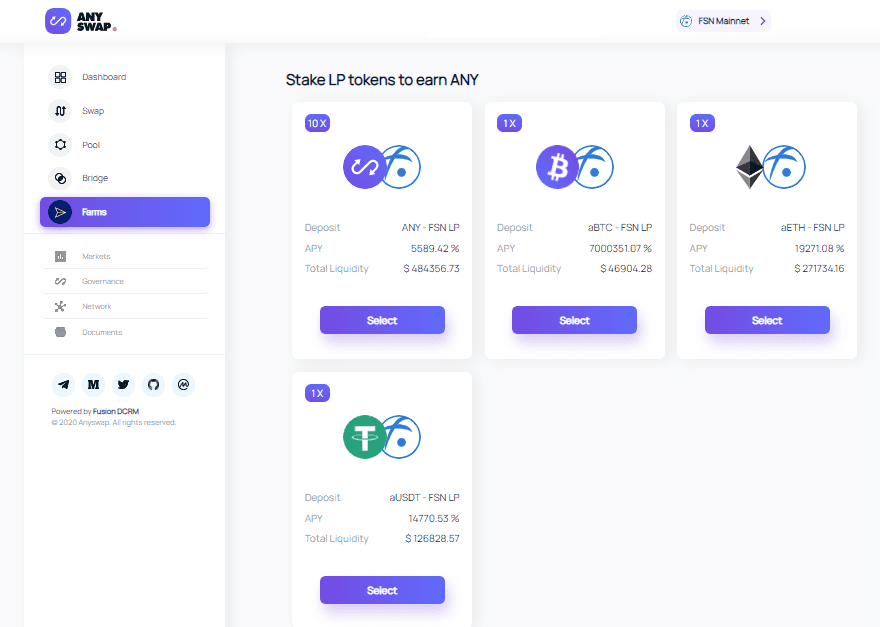

Those interested liquidity mining will find ample opportunity with Anyswap. To begin yield farming through Anyswap, start by connecting your crypto wallet. From there, go to anyswap.exchange, then click on the “Pool” tab to add liquidity.

Here you’ll deposit equivalent values of both ANY and the other token in the pool. You’ll start earning assets immediately upon your deposit. This yield will come in two forms, swap fee accrued within the pool and ANY tokens. For liquidity mining through Anyswap, 9900 ANY is rewarded to liquidity providers every 6600 blocks (approximately 24 hours).

Learn more about farming ANY via Anyswap here.

News & Industry Updates

1.) Biden Accuses Chinese State Actors or Ransomware, Cryptojacking Attacks

The U.S. President accused the Chinese government of supporting cyperattcks, including ransomware, cryptojacking, digital extortion, and theft.

2.) DeFi Traders Lost More than $11M Across Two Weekend Hacks

Over the weekend, DeFi traders lost over $11M across two hacks on the Binance Smart Chain (BSC).

3.) Bitcoin Down 10%, Ethereum Down 15% Over the Past 7 Days

The last week saw both Bitcoin and Ethereum further drop in price during a bearish market

4.) Turkey’s Crypto Bill Ready for Parliament, Says Deputy Minister of Finance

The bill would establish a legal framework for crypto assets in the country and would work to help protect retail investors, prevent money laundering, and reinforce supervision for crypto exchanges.

5.) Robinhood Warns of Expected Drop in Crypto Revenue

In a new security filing, the company said it expects Q3 trading revenue to decline, especially in the case of crypto revenue.