[ccpw id=”424″]

Protocol of the Week

Olympus is a decentralized reserve currency protocol based on the OHM token. A basket of assets backs each OHM token in the treasury. This backing gives every OHM token an intrinsic value it can’t fall below. In the end, Olympus strives to optimize the stability and consistency of OHM so it can function as a global unit-of-account and medium-of-exchange currency. Essentially, the goal of Olympus is to optimize the system for growth and wealth creation.

DeFi Strategy of the Week

Utilizing Olympus to grow your wealth by staking and earning compounding interest.

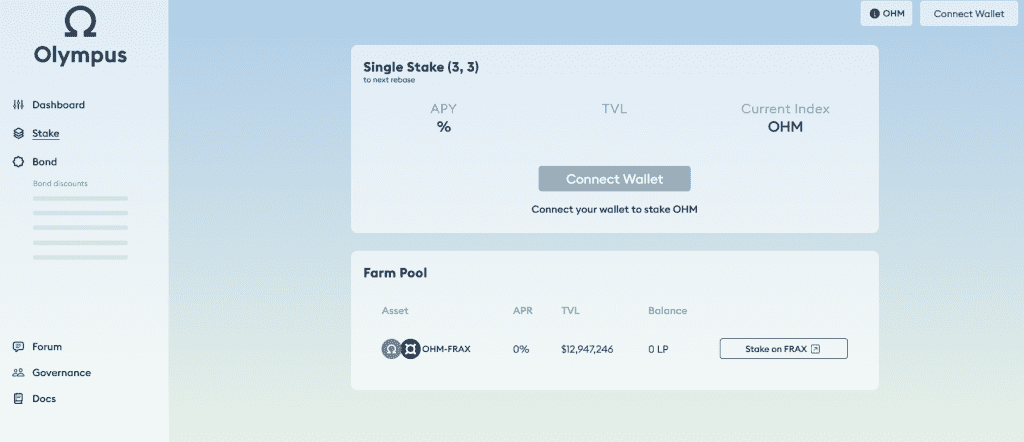

There are two main methods for users to participate in Olympus. You can benefit from Olympus by staking or bonding. Stakers stake their OHM tokens for more OHM tokens. On the other hand, Bonders provide LP or DAI tokens in exchange for discounted OHM tokens after a fixed vesting period.

The primary benefit for stakers comes from supply growth. Olympus Protocol mints new OHM tokens from the treasury, the majority of which are distributed to stakers. So, stakers gain from their auto-compounding balances. Still, you should always be cognizant of your price exposure; if the increase in token balance outpaces the potential drop in price (due to inflation), then stakers profit.

The primary benefit for bonders comes from price consistency. Bonders invest capital upfront and are promised a fixed return at a set point in time. This return is in OHM, so the bonder’s profit is based on the OHM price when the bond matures. Bonders benefit from a rising or static OHM price.

Go to the Olympus App and select which option you’d like to participate in to begin staking or bonding.

Yield Farm of the Week

Yield farming on PancakeSwap.

PancakeSwap is the leading decentralized exchange on the Binance Smart Chain. Because it runs on the BSC, PancakeSwap features lower transaction costs than Ethereum or Bitcoin. Plus, trading fees are lower than other top decentralized exchanges too. CAKE, PancakeSwap’s native token, governs the protocol.

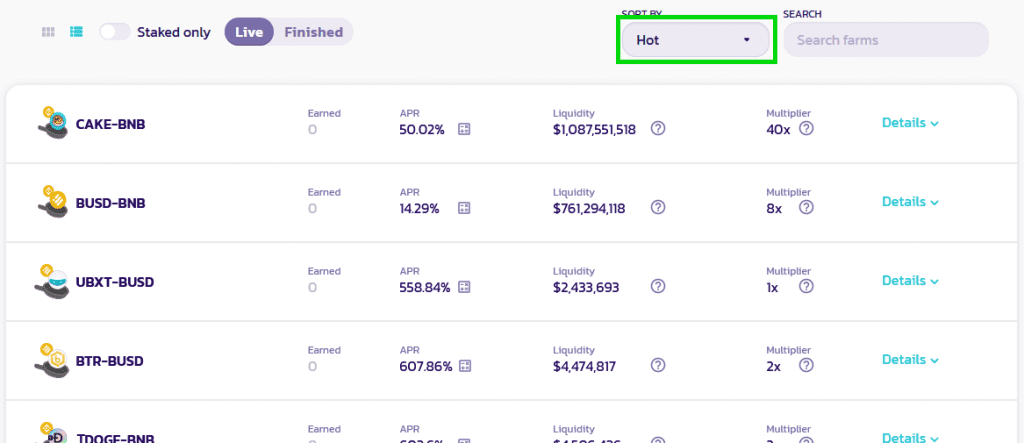

One of the top features of PancakeSwap its Yield Farm. PancakeSwap’s yield farms let users earn CAKE while supporting PancakeSwap by staking LP tokens. PancakeSwap’s farms require users to stake two tokens to get LP tokens, which they then stake in the Farm to earn rewards. This process lets you earn CAKE while also keeping a position in your other tokens.

Note, you’ll need “LP Tokens” to enter into a Farm with. But Farms can only accept their exact LP Token. For example, the CAKE-BNB Farm only accepts CAKE-BNB LP Tokens. Still, before you acquire your specific LP Tokens, you’ll need to pick which Farm is right for you. Visit the Farms page to see a list of farms available on PancakeSwap.

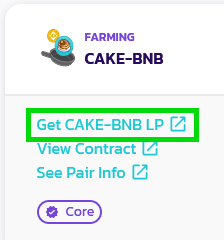

Once you’ve found a Farm you want to stake in, you’ll need to add liquidity to get your LP Tokens. First, click the row of the Farm you’ve chosen. Then, on the left, click the ‘Get (your pair)’ LP link, which will open the “Add Liquidity” page for your Farm’s pair.

Learn more about farming through PancakeSwap here.

News & Industry Updates

1.) Axie Infinity Has Beaten Even Ethereum in Network Fees Thanks to its Sidechain

Protocol revenue on Axie Infinity yielded $305 million over the last 30 days, compared with $91.4 million for Ethereum, according to Token Terminal.

2.) Walmart Seeks Crypto Product Lead to Drive Digital Currency Strategy

The retail giant is looking for an experienced crypto expert to develop and drive an ambitious digital currency strategy and product roadmap.

3.) Biden Administration to Pick Acting Chairman Rostin Behnam to Head CFTC

The regulator is charged with overseeing derivatives market activity, including cryptocurrency derivatives.

4.) Premier League Soccer Team to Wear Dogecoin Shirts in Upcoming Season

Players from Watford F.C. will wear Dogecoin on their shirts this season for sponsor Stake.com.

5.) Microsoft Wants to use Ethereum Blockchain to Fight Piracy

The software developer’s new plan to combat piracy utilizes the transparency of blockchain technology.