[ccpw id=”424″]

Protocol of the Week

Integral – a new automated market maker (AMM).

Integral Protocol is an AMM-based Decentralized Exchange (DEX) that mirrors liquidity on other top exchanges. The Integral protocol aims to provide the cheapest liquidity among all centralized AND decentralized exchanges.

Integral is built to eat other exchanges’ liquidity. Essentially, whenever another exchange attempts to beat Integral, the protocol mirrors this liquidity onto their own pools until they regain the world’s best liquidity again.

DeFi Strategy of the Week

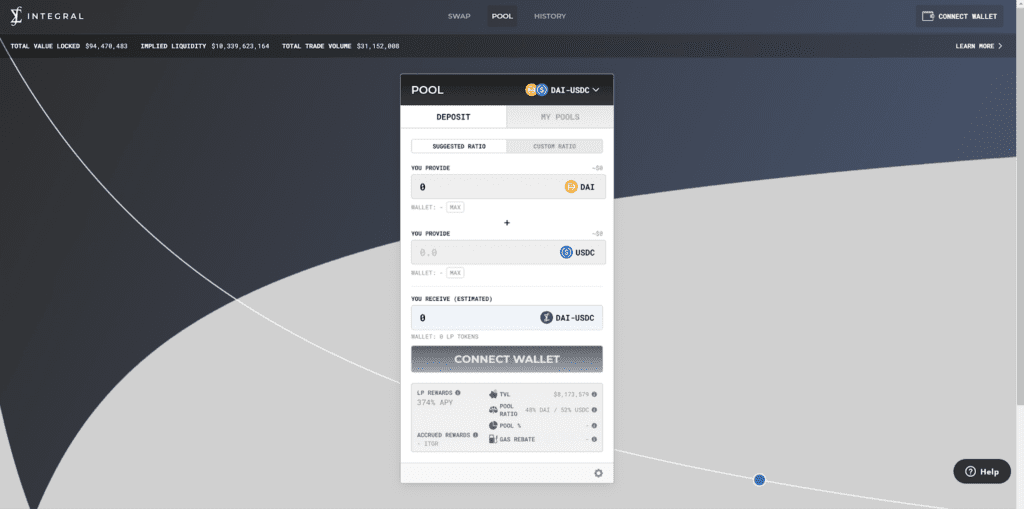

Trading and providing liquidity via Integral.

The Integral Protocol provides three primary systems that differentiate it from other DEXs. The first system is that Integral is a new AMM style called an Orderbook AMM or OB-AMM. This style allows Integral to “mirror” its competitors’ external liquidity at will but need just a fraction of that liquidity in the project’s own pool.

Essentially, Integral can provide 3x the depth of Binance’s orderbook, for example, but needs far less liquidity to do so. This efficiency helps keep price impact lower and the liquidity pool’s APYs higher for users.

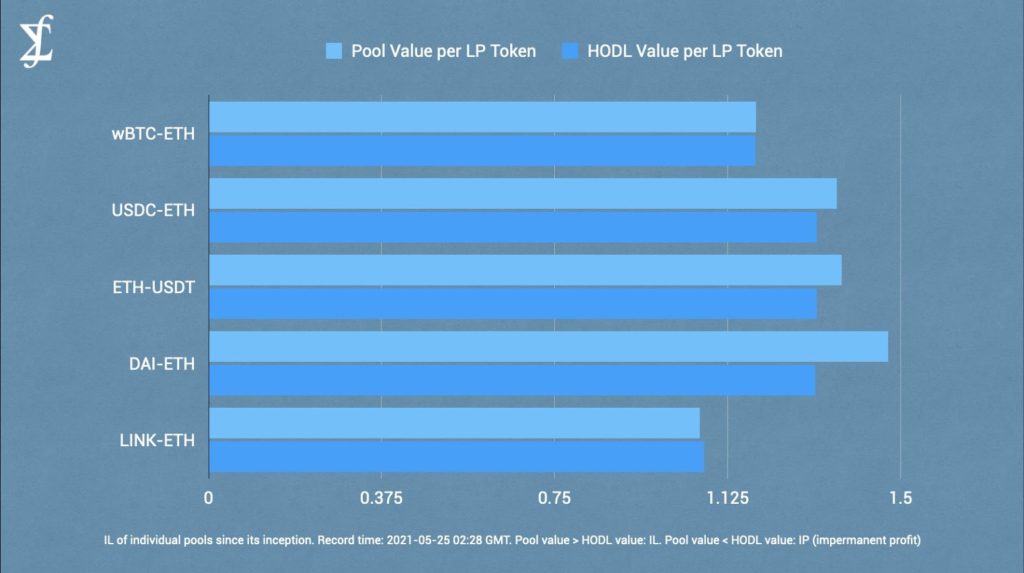

The unique system of Integral is the protocol’s trade delay system. Integral’s trade delay forces traders to wait 5 minutes, plus Ethereum’s confirmation time. This trade delay helps protect liquidity pools from the threat caused by arbitrageurs and frontrunners. The final benefit Inetgral offers over other AMMs is its mean-0 impermanent loss (IL) system.

Each of these systems combines to create Integral’s overall efficiency. Currently, Integral supports four liquidity pools:

- ETH/DAI

- ETH/WBTC

- ETH/USDC

- ETH/USDT

Learn more about trading on Integral or using Inetgral’s liquidity pools.

Yield Farm of the Week

Earn ANT rewards from Aragon for providing liquidity to the ANT/ETH Uniswap pool.

Aragon is a suite of applications and services for creating and managing digital organizations on the Ethereum blockchain. The service was built to disintermediate the creation and maintenance of organizations. Aragon is governed by their native token – ANT.

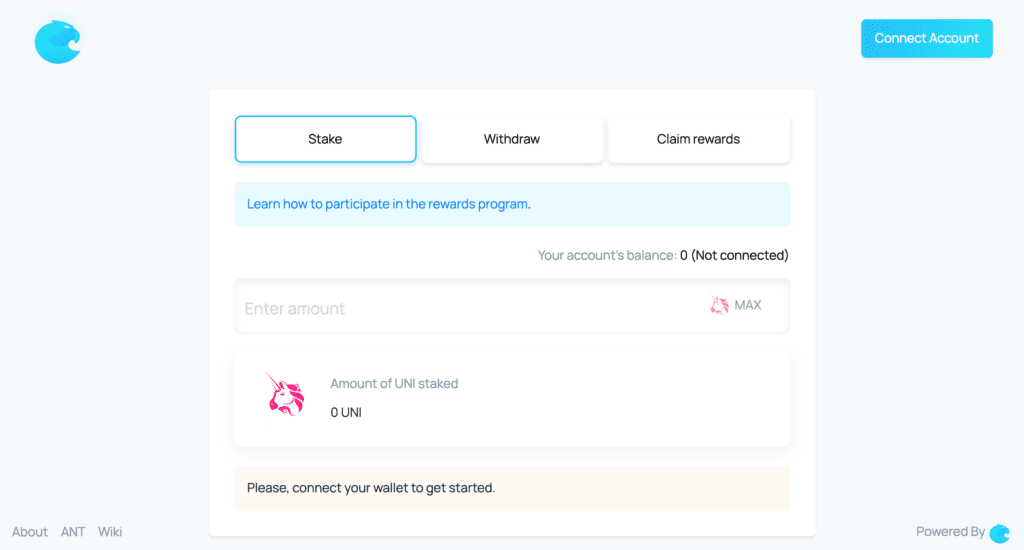

To stake and begin earning ANT liquidity rewards:

- You must provide liquidity to the ANT/ETH pool on Uniswap V2 or the ANT_2/USDC or ANT_2/WETH pools on Balancer.

- For providing this liquidity, you’ll receive tokens based on which DEX you use. Merely providing liquidity will NOT earn you ANT rewards.

- Finally, you must visit liquidity.aragon.org, with the tokens from the previous step in your address. Then, enter the amount of tokens you want to stake and begin earning ANT rewards.

Recently, Aragon announced ANTv2. ANTv2 uses 66% less gas, supports meta transactions, and allows users to vote in Aragon Network votes. Find out more about ANTv2 here.

An learn more about yield farming ANT here.

News & Industry Updates

1.) Mark Cuban Sends Polygon Soaring as Glitch Pings MATIC.

On May 25; news broke that Mark Cuban invested in Polygon, causing a 25% price increase.

2.) How Bitcoin ETFs will Impact the Crypto Market

Recently there’s been a push to approve Bitcoin Exchange-traded funds (ETFs). Advocates believe these investment vehicles would bring a range of benefits to investors.

3.) Coinbase Adds Apple Pay to Crypto Debit Card

Coinebase adding Apple Pay means users will not need a physical debit card. The service will begin unrolling to U.S. users starting this week.

4.) Biden’s 2022 Budget Includes New Crypto Reporting Proposals

The President’s 2022 budget proposal includes several new crypto reporting requirements.

5.) Average Bitcoin Transaction Fees Hit Lowest Level Since January

The average Bitcoin transaction fee is now 0.0002 BTC, or around $7. That’s the lowest it’s been since January 2, 2021, according to BitInfoCharts.