[ccpw id=”424″]

Protocol of the Week

Nexus Mutual

Nexus Mutual is a decentralized insurance protocol built on the Ethereum network. The company uses a risk-sharing pool, much like any other form of insurance, to allow anyone to purchase an insurance cover or contribute capital to the pool for future rewards.

Essentially, Nexus Mutual is aiming to disrupt the insurance industry by transitioning power from large insurance companies back to the individual. Nexus Mutual strives to provide members with simple, transparent, accessible, and affordable financial protection against their risks.

Through Nexus Mutual, DeFi users can utilize insurance plans that protect them against common DeFi investment concerns such as smart contract exploits, network attacks, consensus failures, and more.

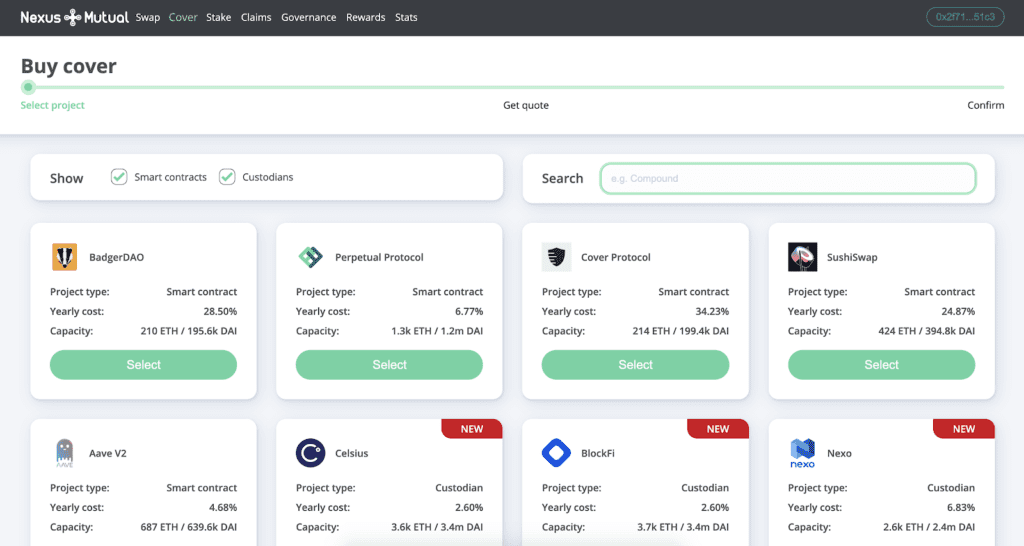

Cover products from Nexus Mutual are priced based on three primary factors. These factors are:

- Value staked by Risk Assessors against the protocol or custodian.

- Cover Amount selected by the user – the payout in case of a successful claim.

- Cover Period selected by the user – the duration of the Cover.

DeFi Strategy of the Week

Using Nexus Mutual to take out covers on Smart Contracts.

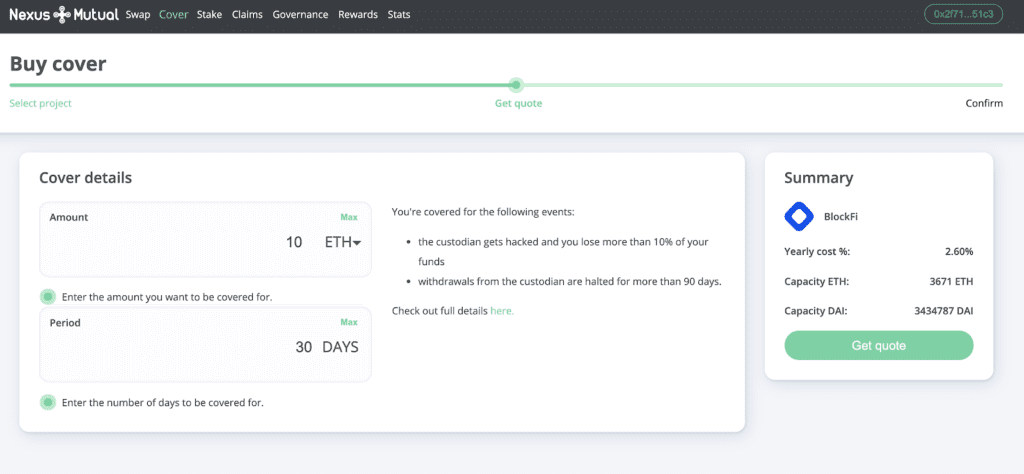

For as little as 2.6% annually, Nexus Mutual offers users a Smart Contract cover, which allows users to protect their crypto investments against a smart contract bug. These covers guarantee a payout in ETH or DAI if a Smart Contract bug is ever discovered in the DeFi app.

Additionally, you can buy insurance policies for payouts in ETH, DAI, or NXM. The protocol will automatically convert contributions to NXM for users who pay their cover with ETH or DAI. You can buy Nexus protection for a 30-day minimum or up to one year or more in length by paying the premium in ETH or NXM.

Once you purchase a cover, you burn 90% of the cover price in NXM tokens and retain 10% to use as a stake, when making a claim.

Yield Farm of the Week

Earn AMPL stablecoins for providing liquidity to the AMPL/ETH Uniswap pool.

Ampleforth is a DeFi solution built on the Ethereum network. The Ampleforth protocol translates price-volatility into supply-volatility, meaning, the number of AMPL tokens in your wallet automatically increases or decreases based on the price. AMPL – Ampleforth’s native token, is a new type of stablecoin.

Every day, Ampleforth makes supply adjustments called “Rebases.” So, when the AMPL network shrinks, you’ll automatically have fewer tokens. And when the network grows, you’ll automatically have more tokens. This rebasing mechanism lets owners use AMPL in Smart Contracts.

Plus, AMPL is non-dilutive. This means supply adjustments are applied universally and proportionally across every wallet’s balance. This setup ensures your percent ownership of the network remains fixed. These unique incentives allow AMPL to decouple from Bitcoin’s price pattern. This decoupling reduces systemic risk by adding diversity to an increasing homogenous crypto ecosystem.

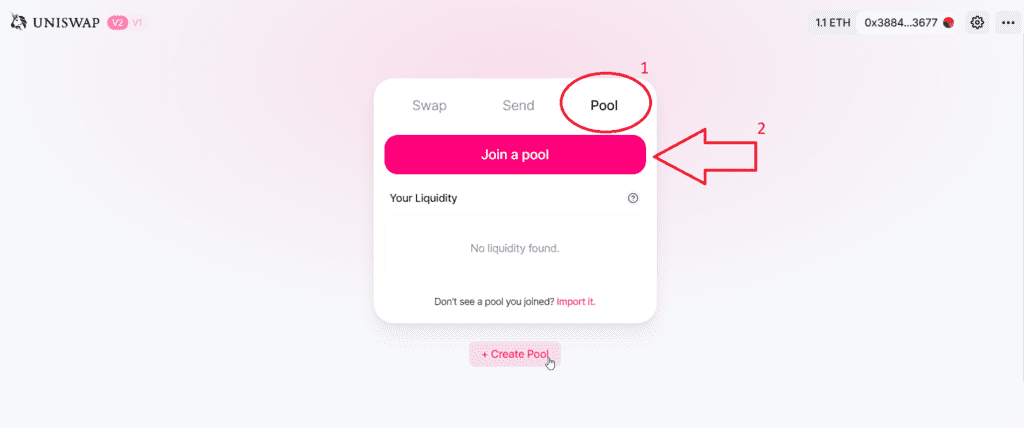

To earn AMPL from Ampleforth’s protocol, your first step should be to lock the same amount of ETH and AMPL on the Uniswap V2 ETH/AMPL pool. This action maintains liquidity in the pool, and Ampleforth rewards you for providing this liquidity.

In exchange for this liquidity, you’ll receive a Uni-V2 token, which you can then stake and receive new AMPL for this staking. Note, you’ll need to buy AMPL on the free market before you can lock it on the pool on Uniswap.

Click here to read an in-depth guide to mining AMPL from Ampleforth.

News & Industry Updates

1.) HSBC “Not Into’ Bitcoin as an Asset Class

European banking giant HSBC says it is not interested in Bitcoin as an asset class, citing its ‘volatility.’

2.) Goldman’s Crypto Chief Worries About Fraud, but Not the Future

Goldman Sach’s global head of Digital Assets said the cryptocurrency space was, “only one big fraud away from a very negative impact on the market.”

3.) Crypto Makes First Attempt to Recover After Worst Bloodbath in Over a Year

Over the past week Bitcoin plunged as much as 30 precent while Ether fell as much as 44 percent. Where does crypto go from here?

4.) Decentralization vs. Centralization: Where does the Future Lie?

Here’s what crypto and blockchain experts think about the dichotomy between centralization and decentralization.

5.) 5 Lessons From Bitcoin’s Very Bad Week

Learn five key takeaways from Bitcoin’s latest week from hell.