Protocol of the Week

Perpetual Protocol

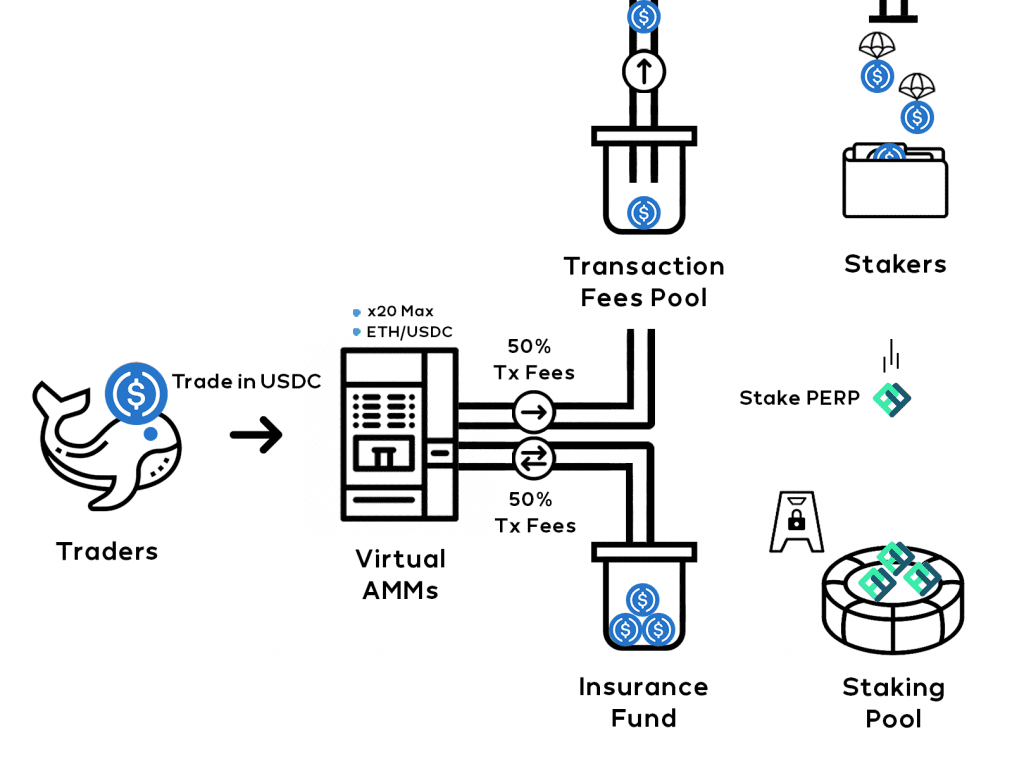

The core product of Perpetual Protocol is their decentralized exchange (DEX), based on Ethereum and xDai. Perpetual Protocol is a decentralized perpetual contract protocol for every asset, possible via a Virtual Automated Market Maker (vAMM).

Users can trade directly with this vAMM without the need for counterparties. The vAMMs also provide guaranteed on-chain liquidity with predictable pricing set by constant product curves. Additionally, these vAMMs are market neutral and fully collateralized.

Perpetual Protocol is governed by their native token – PERP. Perpetual will reward you for staking your PERP with a portion of the transaction fees in stablecoins, plus additional PERP.

DeFi Strategy of the Week

Hedging yield farming risk through perpetual contracts and the Perpetual Protocol DEX.

The primary goal of Perpetual Protocol is to create a perpetual contract trading protocol that anyone can use. Through this protocol, you can trade with good liquidity and low slippage, thanks to the protocol’s vAMM-based exchange.

Plus, Perpetual uses a scaling technology – xDai – to increase trade speeds compared to other Ethereum-based exchanges. And, to top it all off, Perpetual requires zero gas fees on all trades. You don’t even have to set up your wallet to utilize the benefits of Perpetual’s xDai scaling.

A perpetual contract is a derivative (i.e., a financial product whose price derives from another asset) that makes price speculation on an asset easy. So, if you speculate the asset price will go up, then it does; you’ll receive more stablecoins in return. If the price goes the opposite direction, you’ll receive less than the amount you put into the position.

You can use these perpetual contracts to offset some of the impermanent loss risk associated with yield farming. To hedge this risk, you can open a short position at a perpetual contract exchange immediately after you begin providing liquidity.

Learn more about creating a short position via a perpetual contract here.

Yield Farm of the Week

Yearn Lazy Ape Index

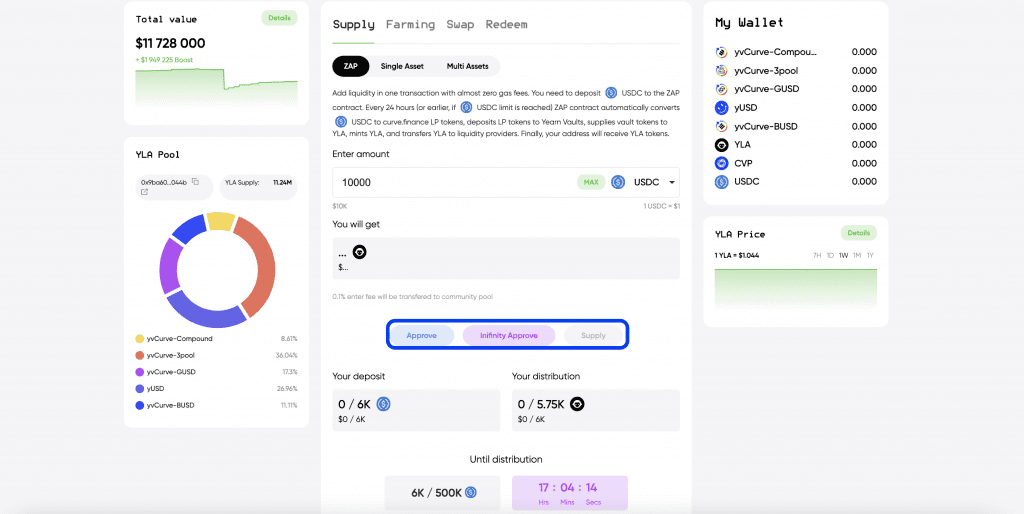

Yearn Lazy Ape (YLA) is a cash-flow generating index. The index is composed of four Yearn v2 stablecoin Vaults LP tokens. Each Vault LP token accumulates interest over time in stablecoins. So, YLA provides diversified exposure to Vaults in a single token.

The Net Assets Value (NAV) of the assets in the YLA pool constantly grows because yEarn vaults accumulate profits inside the YLA pool. So, the price of YLA is appreciating and delivering you returns by just sitting in your wallet.

You can invest (ZAP) in YLA with low fees via this link. Click the link and enter the amount of USDC you want to supply. Then Approve or Infinity Approve your tokens and sign the transaction in your MetaMask. After you sign the approved transaction, hit Supply and sign the supply transaction.

When the transaction is finally confirmed, you’ll see Your Deposit and Your Distribution sections updated, showing your deposit and expected YLA distribution.

News & Industry Updates

1.) Coinbase to Offer $1.5 Billion of Senior Notes in Private Offering

The crypto exchange will offer $1.5 billion of its senior notes – due in 2028 and 2031 – in a private offering. These senior notes are a type of debt-based security similar to a bond but repaid first in case of bankruptcy.

2.) dYdX Drops Over $1B to Past Users in Airdrop

Margin trading protocol dYdX promoted the launch of its native token with one of the largest distributions in the history of decentralized finance.

3.) Report: Bitcoin Mining Power Consumption Exceeds 2020

A recent report from BloombergNEF found Bitcoin miners have already consumed more electricity than they did in all of 2020.

4.) Which Stablecoins Were Actually ‘Stable’ During this Week’s Bitcoin Crash?

Despite the price crash of the top cryptocurrencies, many top stablecoins maintained their one-to-one dollar peg. Learn which were the most ‘stable’ here.

5.) Opolis Deal Deepens Venture Capitalists’ Love Affair with DAOs

Members of the Opolis Employment Commons recently voted to approve the launch of their own DAO. They’ve already contributed $3000K, with a target of $1M in pool collateral.