Protocol of the Week

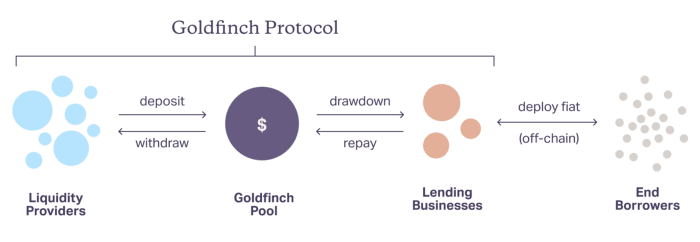

Goldfinch is a relatively new DeFi protocol built to provide loans without collateral. According to Goldfinch, such loans are a vital piece of the DeFi puzzle that will help open crypto lending to most of the world. Through Goldfinch, anyone is a potential lender, not just a bank.

Unlike other crypto lending protocols, Goldfinch doesn’t require over-collateralization with crypto. This feature allows more people to participate and take out a crypto loan than ever. Additionally, Goldfinch provides the means for passive yield by removing the need for crypto collateral.

Consequently, these means dramatically expand both the potential borrowers and capital providers who can participate. More borrowers will have access to crypto, and more capital providers can gain exposure.

DeFi Strategy of the Week

If you’re interested in participating in Goldfinch, you can do so as one of four core participants: a Borrower, Backer, Liquidity Provider, or Auditor.

Borrowers are participants who seek financing. They propose Borrower Pools for Backers to assess. These Borrower Pools contain the terms the Borrower is seeking, like the interest rate and repayment schedule. Backers assess a Borrower Pool and decide whether to supply first-loss capital. After a Backer supplies capital, Borrowers can borrow and repay through the Borrower Pool.

Liquidity Providers supply the capital to the Senior Pool to earn passive yield. The Senior Pool automatically allocates money to the Borrower Pools based on how many Backers participate. When the Senior Pool allocates capital, a portion of its interest is reallocated to the Backers.

Finally, Auditors vote to approve Borrowers. This step is required before a Borrower can borrow. The protocol randomly selects these Auditors – they provide a human-level check to guard against fraudulent activity.

To participate in Goldfinch first, go to their app and connect your Metamask wallet.

If you want to participate as a Borrower, click on Borrow. To participate as a Liquidity Provider, click Earn and select the pool you’d like to contribute capital to.

Yield Farm of the Week

If there’s one consistent attribute of the crypto market, it’s the market’s volatility. These ups and downs can be exhausting for anyone heavily invested or active in the crypto market. Still, there’s one truth almost everyone in the crypto space can agree upon: Over the long run, crypto will continue to grow.

Now, through Cryptex Finance, you can place your money where your mouth is and bet on the crypto’s total market cap. TCAP, by Cryptex Finance, is a fully-decentralized ERC-20 compatible smart contract that tokenizes real-time Total Market Capitalization from all cryptocurrencies and tokens list on the largest crypto data providers.

Through TCAP, you can gain exposure to the entire cryptocurrency market with one investment, without the risk associated with any one of the particular currencies.

Plus, to boost TCAP liquidity, Cryptex offers yield farming rewards with their governance token CTX. Currently, participants receive a rate of 65 percent APY for staking the SushiSwap LP from the TCAP/ETH pool. So, if you participate, you’ll end up with 50 percent TCAP and 50 percent ETH exposure.

If you want to earn these yield farming rewards, begin by becoming a liquidity provider for the TCAP/ETH pool in SushiSwap. You can add liquidity to the LP using any token on Zapper Pools.

Then, go to the Zapper Farm tab and search for TCAP. To begin earning the CTX governance token rewards, you’ll need to click on Show Available to Stake, then click the Stake button for the TCAP/ETH pool. Note, you’ll be required to approve depositing the LP.

After confirming the transaction through Metamask, you’ll click Confirm again to deposit the LP. Finally, return to the dashboard on Zapper to track your earned TCAP/ETH LP rewards. Additionally, you can claim CTX rewards or Unstake your liquidity from this dashboard.

News & Industry Updates

1.) 5 NFT Marketplaces that Could Topple OpenSea in 2022

In 2021, OpenSea cemented itself as the reigning NFT marketplace. Here are five rivals that could potentially top it in 2022.

2.) Cardano Reaches Goal of Planting 1M Trees

The Cardano Foundation, a non-profit that oversees developments on the Cardano network, reached its goal of planting over 1 million trees.

3.) Rug-Pullers and Black-Hats Ran Wild in 2021 with $2.2B Lost to Theft

A new report from Chainalysis, a blockchain forensic analysis firm, found rouges stole $2.2B in digital assets from DeFi protocols last year – a 13-fold increase from 2020.

4.) This NFT Farming Game is Clogging up Ethereum Scaling Solution Polygon

Polygon is built for crypto games, but Sunflower Farmers’ sudden surge in players has spiked gas fees and slowed transactions.

5.) 5 NFT-based Blockchain Games that Could Soar in 2022

NFTs, look ready to rule 2022. The recent pivot to NFT utility in P2E gaming could make blockchain gaming this year’s sector darling.