[ccpw id=”424″]

Protocol of the Week

Opyn.co

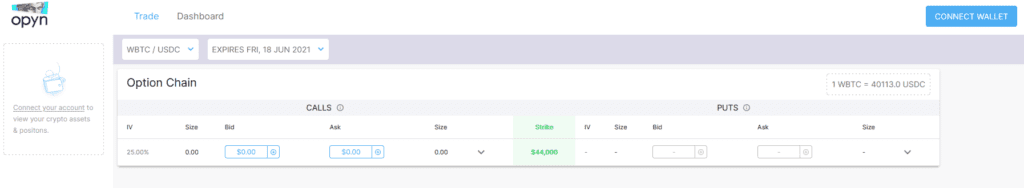

Opyn.co builds protocols on the Ethereum blockchain that allows individuals to buy, sell, and create options on ERC-20s. Essentially, crypto investors can use Opyn’s smart contracts to hedge against DeFi risks and take different positions on different cryptocurrencies.

Opyn itself is built on a Convexity Protocol. Due to its resulting incentive-compatible design, Opyn is completely non-custodial and trustless. Which means, the protocol doesn’t require claim assessors or risk assessors to validate claims.

DeFi Strategy of the Week

Protecting you DeFi investments with options from Opyn.co.

Options are derivative contracts that give the buyer the right, but not the obligation, to either buy or sell a fixed amount of an underlying asset at a fixed price on a certain date. In DeFi, these underlying assets can include any ERC-20 assets like – WETH, WBTC, UNI, YFI, SNX, and more.

You can use options for any number or reasons: income generation, speculation, and hedging. Due to the volatility of the cryptocurrency market, many use options to hedge against declining asset prices. Hedging against a crypto’s price allows investors to limit downside losses. Similarly, many use options to generate recurring income or for speculative purposes.

Through Opyn.co, you can buy or sell protection, or develop new option assets. There are two primary options you can utilize via Opyn – put and call options. A call option, is an option that gives the option buyer the right to buy the underlying asset. A put option, is an option that gives the buyer the right to sell the underlying asset.

As previously state, Opyn is built on the Convexity Protocol and is permissionless. Due to this permissionless nature, options sellers can earn significant premiums on their collateral by depositing ETH, minting put options, and selling them on the open market and earning a premium.

To utilize these crypto options, connect your wallet to Opyn and begin selling, trading, or protecting crypto assets.

Yield Farm of the Week

SNX staking and sUSD/sETH liquidity incentives through Synthetix.

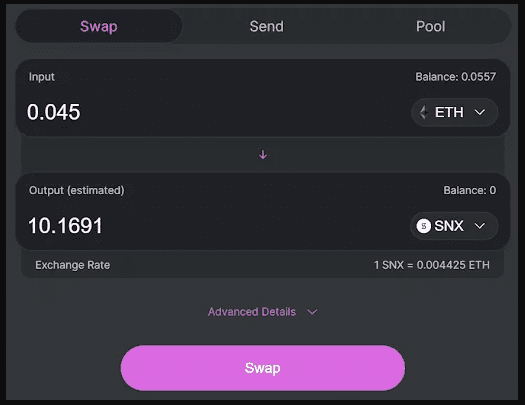

Synthetix is a permissonless derivatives platform built on the Ethereum network. Users can generate synthetic assets – Synths – by staking Synthetix Network Tokens (SNX). Through Synthetix assets, investors can gain exposure to real-world derivatives without having to maintain custody of the underlying asset. Plus, you can get this exposure while avoiding slippage, delays, or exchange withdrawal fees.

There are several ways users can generate yield through Synthetix. You can earn rewards by providing liquidity to the sUSD or sETH pools. Or, you can earn rewards by staking Synthetix’s governance token – SNX.

Users who stake SNX receive rewards from two sources – trading fees from the Synthetix Exchange and SNX weekly via inflation. Both of these mechanisms are designed to drive users to stake their SNX tokens. To stake SNX, you must first acuqire it. You can do so directly with ETH or other tokens on Uniswap.

You can an in-depth breakdown of staking SNX here.

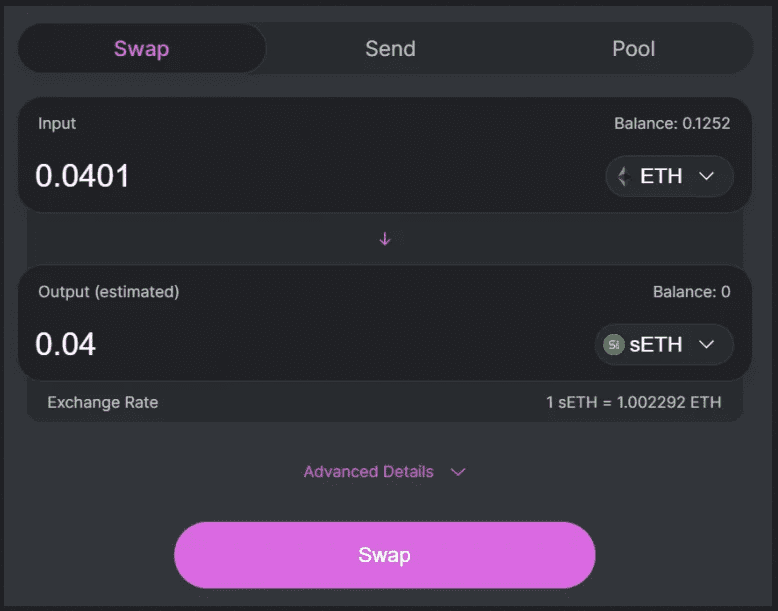

In addition to staking SNX, one of the primary means of generating yield through Synthetix is to provide liquidity to their sUSD or sETH pools. To provide sETH liquidity, you must hold both ETH and sETH in the same wallet. You can directly acquire sETH on Uniswap.

Click here to read a detailed explanation of obtaining sETH and sUSD liquidity incentives.

News and Industry Updates

1.) Report: Goldman Sachs Plans to Offer Ether Options

This despite the fact the banking giant also recently said it doesn’t view crypto as a ‘viable investment.’

2.) Curve Finance Releases Protocol’s First Heterogeneous-Asset Pool

Curve rocked the DeFi world this week, when it announce the release of its first heterogeneous-asset pools.

3.) Here’s How Pros Safely Trade Bitcoin While it Range Trades Near $40K

Traders who are unsure about Bitcoin’s chance of continuation above $40,000 can use a combination of protective put options to generate profit.

4.) G7 Commits to Fighting Cryptocurrency-Fueled Ransomware Attacks

G7 leaders have committed to fighting ransomware attacks, such as those recently proliferated by Russia-based gangs.

5.) Stablecoins Prove Their Worth During Crypto’s Slide

Despite the DeFi Pulse Index being down 40% this month, and the overall crypto market losing 1/3 of its value, stablecoins have continued on an upward trajectory.