[ccpw id=”424″]

DeFi Strategy of the Week

Lending through MakerDAO.

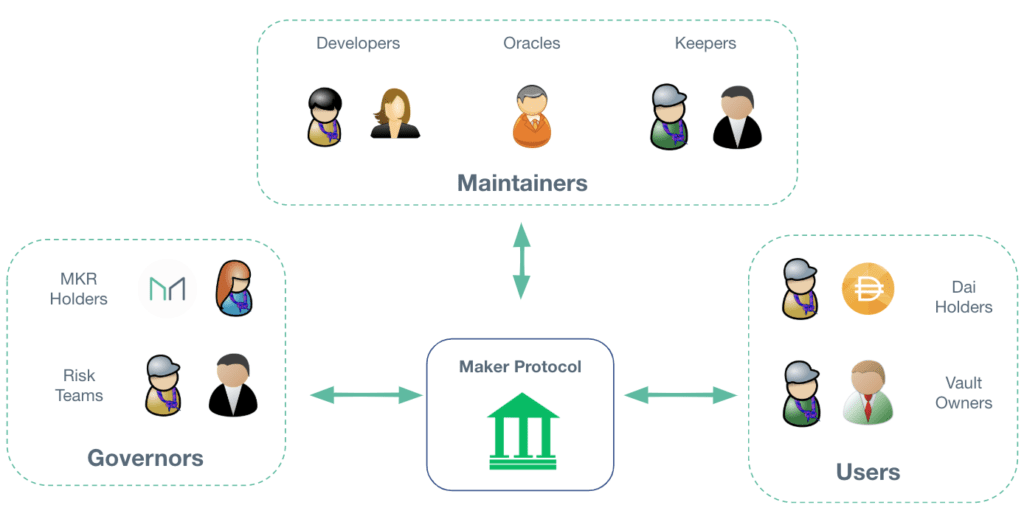

MakerDAO is a permissionless lending platform, responsible for the creation of Dai ($DAI), the first decentralized stablecoin, built on Ethereum. Similarly, the Maker Protocol is one of the largest decentralized apps (dApps) on the entire Ethereum blockchain.

The platform allows any user to autonomously take out a loan by staking assets, such as ETH, as collateral. Being permissionless, means there are no KYC requirements necessary to start. Plus, all lending actions are performed via smart contracts, which means no humans are involved in the facilitation of an specific loan.

Some of the parameters you define in your smart contract’s creation include:

- Liquidation Price – The price at which your loan is forced to liquidate, a.k.a. “margin called.”

- Liquidation Penalty – The mandatory fee that’s paid if you’re liquidated. Penalties are charged as a portion of existing collateral and are dynamically adjusted based on the Maker governance decision.

- Collateralization Ratio – An indicator to see how leveraged your wallet is. It’s typically recommended you maintain a ratio of at least 50% above your forced liquidation to account for price swings.

- Minimum Ratio – The ratio at which you will be forced to liquidate, should your collateralization ratio fall below this ratio.

- Stability Fee – A fee you need to pay in parallel with the DAI you borrowed to close your loan. As stability fees must be paid in either Maker’s native token (MKR) or Dai (DAI).

MakerDAO’s native token is MKR. Outside governance, you can use MKR to pay for stability fees, and in the case of an emergency, sell to ensure DAI maintains its 1:1 peg with the U.S. dollar.

Yield Farm of the Week

Earn SUSHI governance tokens by providing liquidity to SushiSwap’s incentivized liquidity pools.

SushiSwap is an automated market-making (AMM) decentralized exchange (DEX) on the Ethereum blockchain. Sushi was built to solve the “liquidity problem” in crypto. Sushi intends to create a broader range of network effects by intertwining several decentralized markets and instruments.

Also, unlike centralized exchanges, SushiSwap doesn’t need to possess your tokens for you to trade them. As a decentralized exchange, SushiSwap allows users to trade trustlessly, peer-to-peer, with liquidity supplied by other users. So, new projects can more easily connect to their desired markets, as long as an entity is willing to provide the liquidity.

For every swap on the SushiSwap exchange, on every chain, 0.05% of the swap fees are distributed as SUSHI proportional to your share of the SushiBar. When you stake your SUSHI in the SushiBar, you receive xSUSHI in return for voting rights and a fully-composable token that interacts with other protocols. And your xSUSHI is continuously compounding.

Plus, SushiSwap claims to have the largest and most-effective system in DeFi for farming yield. This effectiveness is possible because almost every token on Sushi is natively yield bearing, which enable Sushi to function extremely efficiently. Anytime you add liquidity, to any branch of the Sushi platform, it allows the platform as a whole to be more efficient.

You can read an in-depth guide to farming SUSHI on SushiSwap here.

News & Industry Updates

1.) Bitcoin: Inflation Hedge or Not?

Economists and investors weigh in on whether Bitcoin is a store of value in times of inflation or not.

2.) Coinbase President: Crypto is Currently Comparable to the Early Days of Cell Phones

Emilie Choi, Coinbase’s president and COO, believes the crypto industry currently mirrors the early days of the cell phone industry in multiple aspects.

3.) Allianz: Crypto Exposure May Impact Risk Profiles

According to Allianz Global Corporate and Specialty, exposure to cryptocurrency could have a profound impact on the risk profiles of many financial institutions.

4.) Global Report on Women, Cryptocurrency and Financial Independence

Cryptocurrency could help more women get involved in the global economy and grant them financial independence.

5.) You can Now Buy NFTs on eBay

eBay is now allowing users to buy and sell NFTs on its platform. Plus, ‘blockchain-driven collectibles’ are coming soon.