[ccpw id=”424″]

Protocol of the Week

BlockFi is a cryptoasset service platform built to provide three primary options for crypto investors. Through BlockFi, you can buy and trade cryptocurrencies, borrow USD, and earn interest on your existing investments.

The firm sets itself apart from other cryptoasset service providers by pairing market-leading rates with traditional institutional-quality benefits. Unlike its competitors, BlockFi doesn’t offer a native governance token. Instead, the firm provides simple, easy-to-use products, including its primary draw and crypto savings accounts.

DeFi Strategy of the Week

Using BlockFi to level up your crypto savings.

Finding a worthwhile fiat savings account is becoming increasingly difficult. Most institutions offer interest rates less than 1% – or even 0.1%. So, many investors are looking for a place to put their savings to grow at a rate that will actually outpace inflation.

Enter crypto savings accounts. Like the accounts offered by BlockFi, crypto savings accounts provide savings accounts options for investors looking for a reasonable interest rate. These savings accounts work like typical savings accounts, but you deposit cryptocurrency rather than fiat. Then, these institutions make loans of your cryptocurrency to other investors.

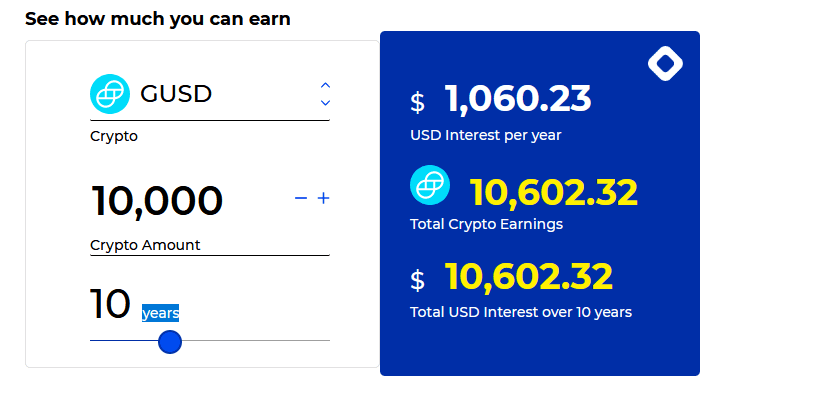

Through a BlockFi Interest Account (BIA), you can deposit your crypto and earn compounding interest from your investments. What sets BlockFi’s Interest Accounts apart from traditional fiat savings accounts is its high annual percentage yield (APY).

As previously mentioned, the APYs of fiat savings accounts usually don’t rise above 1%. But through BIAs, you can earn up to 7.5% on your savings, paid out at the beginning of every month.

Yield Farm of the Week

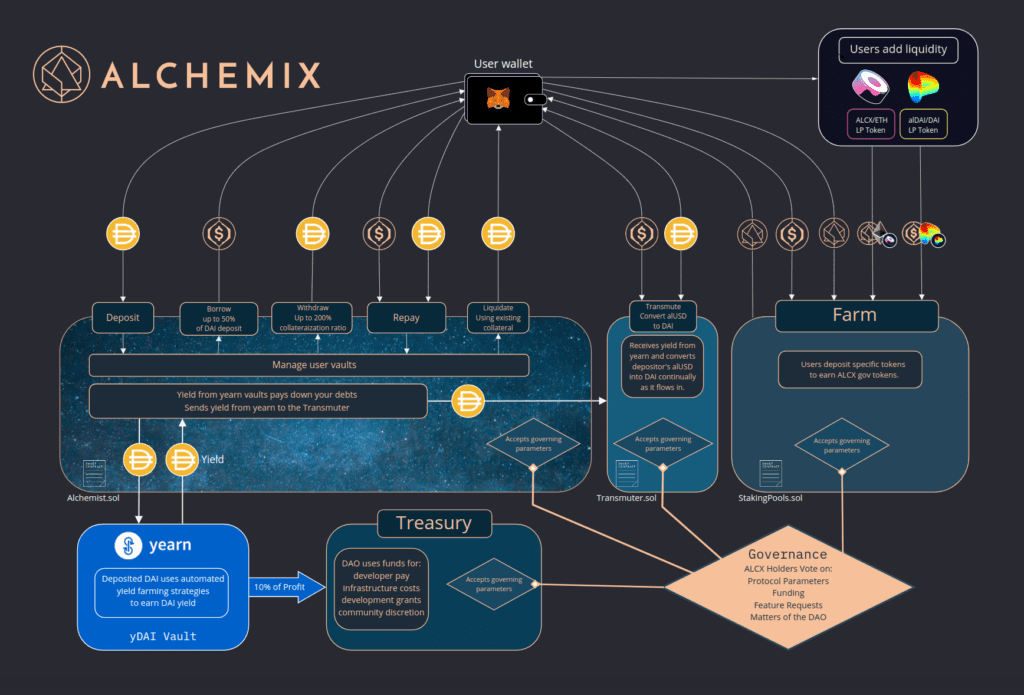

Alchemix Finance is a DeFi protocol that provides highly flexible and instant loans which repay themselves over time. Through this protocol, borrowers can lock up collateral in an automated yield-earning strategy while simultaneously borrowing an advance on their yield in the form of synthetic assets.

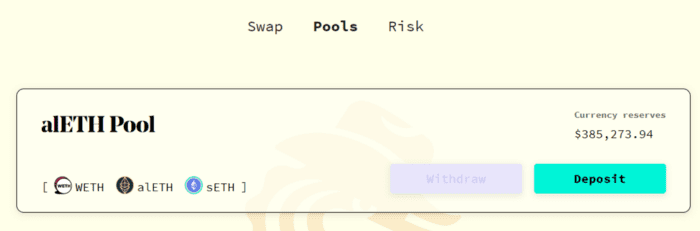

Alchemix offers several yield farming opportunities you can find here. Today, though, we’re going to focus on one of these offerings, Alchemix’s alETH Pool, which investors have recently used to earn up to 30% APR in ALCX rewards.

To take the first step to invest in this alETH Pool, go to saddle.exchange and select “Pools” at the top of the page. From there, click the “Deposit” button next to the alETH pool. Currently, you need to deposit ETH as WETH, or wrapped ETH. You can wrap ETH at many places like Balancer or Zapper.

Note, in the early phase of investing in this pool, you’ll likely experience an impermanent loss if you deposit only one of the assets, or deposit them in an imbalanced manner. So, when making your initial investment, try to add liquidity as balanced as possible, especially while the pool is still young. When there is more liquidity in the pool, it’s safer to complete single-side deposits.

You can read an in-depth breakdown of how to farm Alchemix’s alETH Pool on Saddle Finance here.

News & Industry Updates

1.) Uniswap DeFi Token UNI Rises 9%

UNI – the native governance token of Uniswap – increased 9% in a 24-hour period and 29% over the past week.

2.) New Report: U.S. at Top of ‘Crypto-Ready’ Countries

Crypto Head’s 2021 Crypto Ready Index placed the U.S. as the world’s most “crypto-ready” country.

3.) Federal Reserve Bigwig Defends Stablecoins as Alternative to Digital Dollars

Randal Quarles, the vice-chair for supervision at the Federal Reserve, recently spoke about the promise of stablecoins.

4.) How this Trading Platform is Helping Users Hold on to Their Crypto

This trading platform is offering a solution to help make it easier for people to hold on to their cryptocurrencies.

5.) America’s First Legal DAO Approved in Wyoming

Wyoming – the first U.S. state to grant a charter to a crypto bank – recently approved legal status for a decentralized autonomous organization (DAO). This is the first state-approved DAO in U.S. history.