Protocol of the Week

Lido Finance

Lido Finance is a liquid staking protocol build for ETH 2.0. Through Lido, you can stake your ETH without locking assets or maintaining infrastructure. Plus, you can stake while also participating in on-chain activities such as lending. Lido also solves the primary problems present with initial ETH 2.0 staking, including liquidity, immovability, and accessibility.

But, through its ability to make ETH liquid, Lido lets you participate with any amount of ETH to improve the security of the Ethereum network. Lido’s native token – LDO – governs the protocol. Holding a LDO token grants you voting rights within the Lido DAO.

DeFi Strategy of the Week

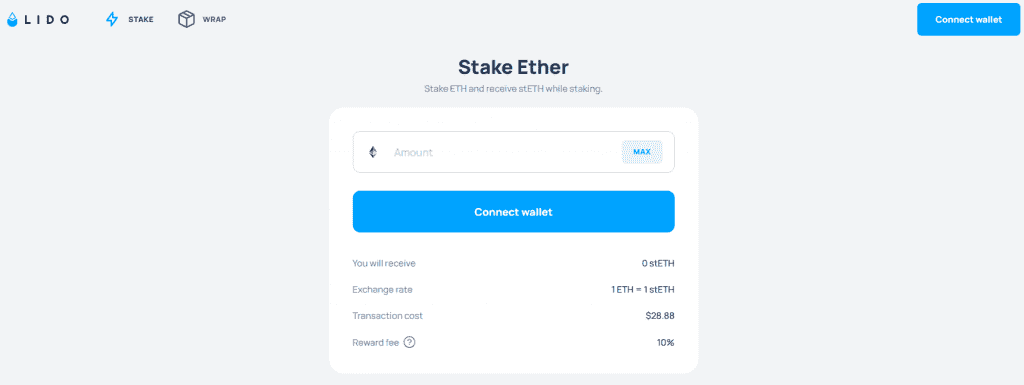

Staking ETH via Lido Finance

When you use Lido to stake your ETH, you receive a token (stETH) representing your ETH on the Ethereum beacon chain on a 1:1 basis. So, it effectively acts as a bridge between ETH 2.0’s taking rewards to ETH 1.0.

As your staked ETH generates rewards from ETH 2.0, your ETH balance on the beacon chain will increase. Subsequently, your stETH balances will update correspondingly once per day. This update allows you to access, on ETH 1.0, the value of your staking rewards received on ETH 2.0.

As previously stated, Lido works to remove the adversarial incentives of ETH 2.0. The protocol achieves this feat by allowing users to stake their ETH while simultaneously participating in on-chain lending with seETH. So, Lido users get access to additional yield from other protocols as well as increased network security.

Yield Farm of the Week

Using Mushrooms Finance to yield farm.

Mushrooms Finance is a crypto yield optimizer with a focus on finding sustainable profits within the DeFi universe. The protocol accomplishes this goal via innovative products like its auto portfolio-rebalancing tool. Currently, Mushrooms Finance supports 34 earning vaults: 17 on Ethereum, eight on Fantom, seven on BSC, and two on Polygon.

Mushrooms uses its native MM Token to govern the protocol. You earn MM through Mushrooms three primary categories of farming pools:

- Staking mTokens from Vault deposit

- Staking Liquidity Provider (LP) tokens for MM from Uniswap (MM-USDC) or Sushiswap (MM-ETH or MM-KP3R)

- Or staking MM Tokens

You can access Mushrooms Farms or Vaults via their website. To begin investing, connect your wallet and deposit your crypto assets.

News & Industry Updates

1.) Coinbase to Allow U.S. Users to Deposit Paychecks Directly in Crypto

The crypto exchange giant will enable U.S. customers to deposit all or part of their paychecks in cryptocurrencies or dollars without a fee.

2.) Robinhood Crypto COO, CTO Hint DeFi Features are Coming

Christine Brown, COO of Robinhood, says the platform’s forthcoming crypto wallet “is the first step” toward helping customers “use your coins to do things in the crypto ecosystem.”

3.) Twitter Goes Full Crypto with Bitcoin Tips and a NFT Avatar Tool

Twitter is making two major updates that will make cryptocurrency integral to its platform. First, you’ll now have the option to tip in Bitcoin. Second, through Twitter, you’ll be able to authenticate that a person owns the NFT they use for their profile picture.

4.) Small Business Advocacy Group Recommends Congress ‘Clarify the Status of Digital Assets’

The SEC’s Office of the Advocate for Small Business Capital Formation recommended that Congress “clarify the status of digital assets to make clear when it is a security.” Learn more about these recommendations and their potential effects here.

5.) Decentralized Exchange Tokens Boom as Chinese Investors Look for Alternatives

Multiple DEX tokens have soared in the past 24 hours, with some protocols trading volumes surpassing those of large centralized exchanges.