Protocol of the Week

Element Finance is a DeFi protocol that allows investors to utilize high fixed and variable yield income. Through, Element, users can access these crypto assets at a discount without being locked into a term. Plus, via the protocol, you can exchange discounted assets and base assets at any time.

DeFi Strategy of the Week

Utilizing fixed and variable yield markets through Element Finance.

Element Finance enables users to purchase BTC, ETH, and USDC at a discount on AMMs (like Balancer), without locking into a fixed term. Without this fixed term, users can easily swap between the discounted asset and any other base asset, at any time.

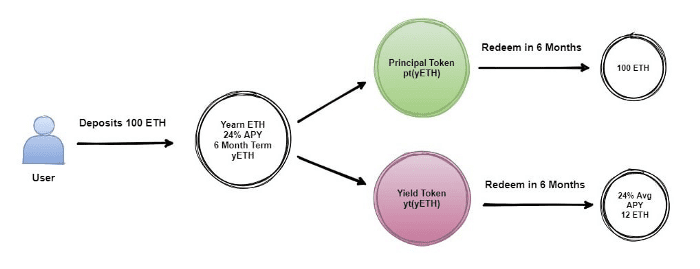

At its core, the Element Finance protocol splits the base asset positions (ETH, BTC, USDC) via Ethereum contracts into two distinct tokens: the principal token (PT) and the yield token (YT). This splitting mechanism lets users sell their principal as a fixed rate income position, further increasing exposure to interest without any liquidation risk.

Element Finance drives high fixed yield markets through this mechanism by bringing liquidity to fixed yield income while minimizing slippage and fees as the discount decreases.

Yield Farm of the Week

Farming CORE and other tokens via cvault.finance.

CORE is a non-inflationary cryptocurrency designed to execute profit-generating strategies independently with a completely decentralized approach. Unlike other DeFi protocols, CORE is community-run and governed by a vote of the community.

Two primary products comprise the CORE Vault ecosystem. These two products are:

- Deflationary Farming through CORE staking

- Automated Strategy Vaults

Today, we’re going to focus on deflationary farming to yield CORE. As a CORE token holder, you can provide strategy contracts and vote on what goes live and when. Plus, Core uses 5 percent of all profits generated from these strategies to auto market-buy CORE tokens.

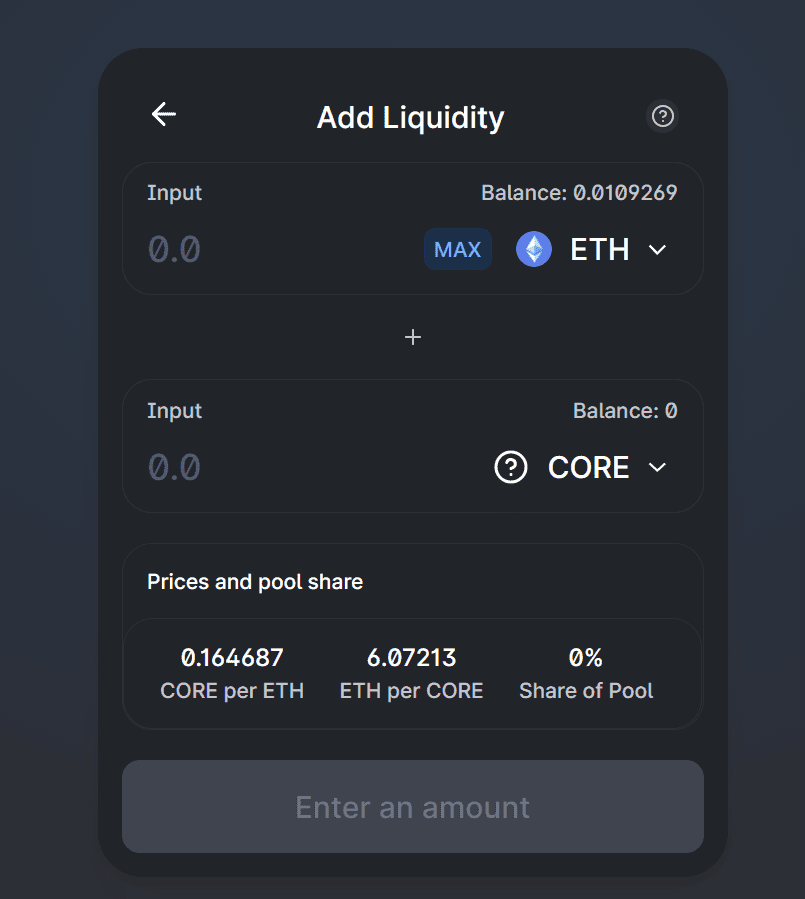

To begin farming CORE, you’ll first need to obtain UNI-V2-LP tokens and stake them on cvault.finance. You can get UNI-V2-LP tokens by providing Ethereum and CORE as liquidity on Uniswap. After receiving these liquidity tokens, users can then stake them on cvault.finance to begin farming more CORE.

When farming, CORE Vault users will receive CORE staking rewards. The amount of staking rewards you need depends on the amount of LP tokens staked and the current APY.

News & Industry Updates

1.) DeFi Regulation Could Hit Prices of Hottest Ethereum Tokens: eToro CEO

Yoni Assia, CEO of eToro, believes new regulation could throw cold water on the recent price surges for the hottest DeFi tokens.

2.) Bug in Leading Ethereum Node Software Caused the Chain to Fork

A bug in one of the leading Ethereum client node operators, Geth, is causing forks on the chain. These forks could enable double spends and other mistakes.

3.) Cream Finance Platform Loses $19M in a Flash Loan Hack

Cream Finance, a DeFi lending protocol, recently suffered a severe exploit. Monday, Cream announced a hacker had stolen almost $19 million from its platform.

4.) John Paulson Calls Cryptocurrencies ‘Worthless’ but Says he Won’t Short Them

John Paulson, who made a fortune shorting the U.S. housing market in 2008, recently said he remains strongly opposed to investing in crypto. Read more of his comments here.

5.) Mastering Emotions and Managing Risk in Cryptocurrency Trading

Through a combination of technical and fundamental analysis, you can better reduce your exposure to volatility while also securing a greater chance of success with a particular investment. Learn more here.