[ccpw id=”424″]

Protocol of the Week

DeFi Yield Protocol is a unique protocol that rewards users for providing liquidity, with ETH. DeFi Yield Protocol uses an anti-manipulation tool to convert mining rewards without severely impacting the price. The protocol is governed through their DYP token.

Through the DeFi Yield Protocol, you can stake DYP, mine ETH, earn DYP via vault yield farming, and buy & sell NFTs. You can learn more about the DeFi Yield Protocol here. Or start exploring DYP’s various tools here.

DeFi Strategy of the Week

Because DeFi Yield Protocol is a multi-faceted platform, there are several ways you can use it to reap crypto rewards. We’ll briefly cover a few of these below.

DYP Staking Pools

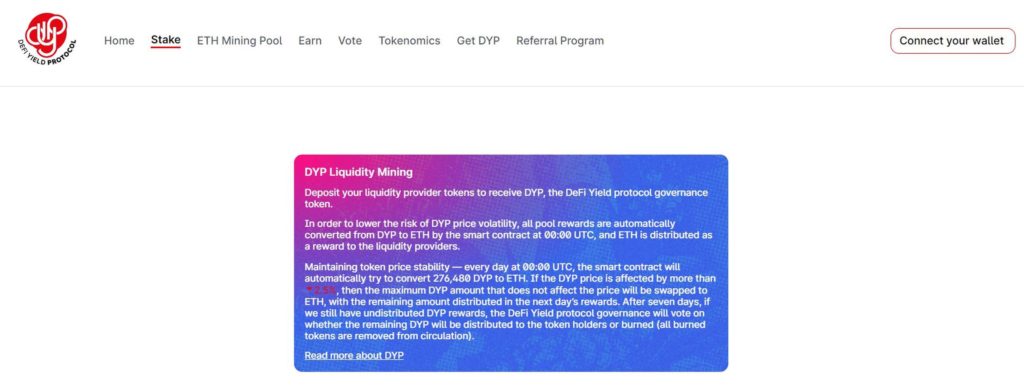

To begin providing liquidity and earning ETH rewards via DYP, you’ll need to deposit your liquidity provider (LP) tokens into one of the following pools:

- DYP/ETH

- DYP/USDC

- DYP/USDT

- DYP/WBTC

From here, you’ll start earning DYP. To help offset the volatility of yield farming, all pool rewards are automatically converted from DYP to ETH by the smart contract (these conversions take place every day at 00:00 UTC). Finally, this ETH is distributed as rewards to LPs.

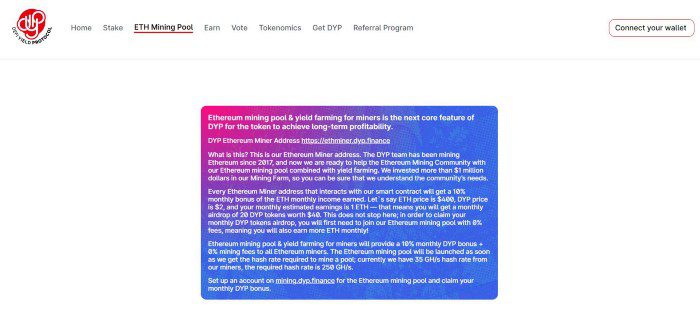

Ethereum Mining Pool & Yield Farming

Through DeFi Yield Protocol, you can also become an Ethereum Miner. Every Ethereum Miner whom does so by interacting with DYP’s smart contracts get a 10% monthly bonus of the total ETH monthly income earned by DYP miners. To claim this monthly DYP token airdrop, you’ll first need to begin Ethereum mining via DYP.

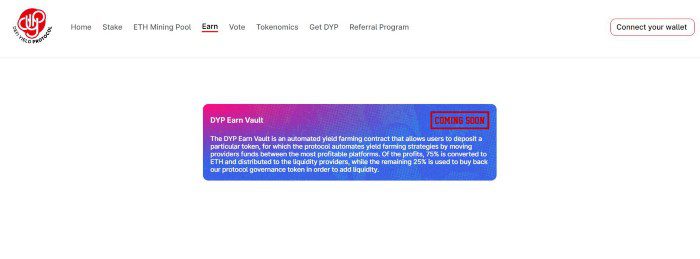

DYP Earn

The DYP Earn Vault is an automated yield farming contract. This contract permits users to deposit a particular token, for which the protocol automates yield farming strategies. The contract accomplishes these strategies by moving providers’ funds between the most profitable platforms.

Of these profits, 75% is converted to ETH and distributed to liquidity providers. DeFi Yield Protocol uses the remaining 25% to buy back protocol governance tokens – DYP – to add liquidity.

Yield Farm of the Week

One of the most recognized crypto exchanges, SushiSwap, is also one of the best platforms for those looking to invest in crypto liquidity mining. SushiSwap offers a large menu of liquidity pool, any of which you can invest in at any time. But the platform also offers extra incentives for those providing liquidity to selected liquidity pools.

These pools are selected via the Onsen program, formerly known on SushiSwap as the ‘Menu of the Week.’ This list is updated every 60 days, with a maximum of 58 token pairs. SushiSwap provides these extra incentives for potential investors as a way to secure more liquidity on a new or popular market.

You can find the Onsen list of liquidity pools in the Yield tab on Sushi.com.

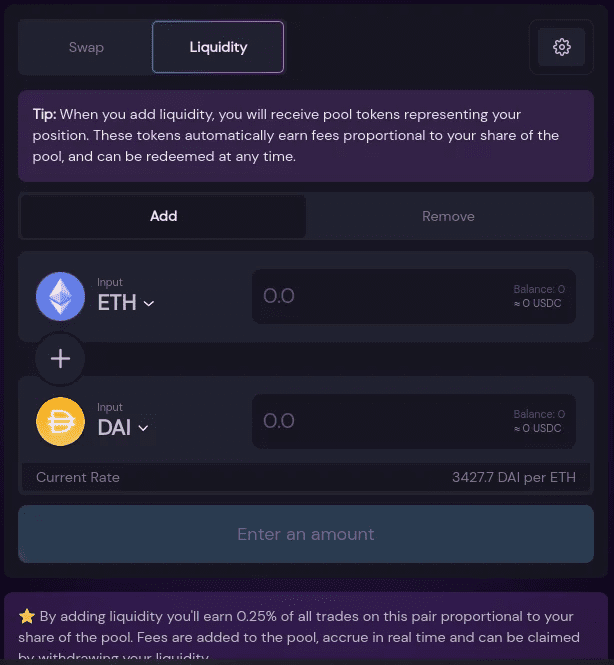

To begin yield farming on SushiSwap, go to the SushiSwap app and click on the liquidity tab. From there, you input how much capital you want to provide. Remember, in SushiSwap pools, you must supply liquidity to both sides of a given pool in equal amounts.

So, for example, if you want to supply capital to ETH/DAI, you must supply equal value of both ETH and DAI to the pool. Once you’ve determined the amount of capital you’re investing, SushiSwap will give you a liquidity token. These liquidity tokens represent a claim on your share of capital within the pool.

You can redeem these liquidity tokens for underlying collateral whenever desired. Plus, as an LP, you’ll receive a majority (0.25%) of the 0.3% fee charged to traders on SushiSwap. You receive these fees as liquidity added back into the pool.

News & Industry Updates

1.) Ethereum Investment Funds Saw Record Outflows of $50M

Recent news has seen a rash of exits from digital investment products, including Ethereum. Net outflows totaled $44 million the past week, and were even higher at $50M the week prior.

2.) 4 Ways Investors Use Support & Resistance Levels for Better Trades

Properly identifying support and resistance levels is oftentimes the primary difference between you winning a trade or suffering significant losses.

3.) Crypto Investments in India Soar by 19,900% in One Year

Despite facing a high-level of regulatory uncertainty, crypto investments in India grew from $200M to nearly $40 billion over the past year.

4.) DeFi ‘Revenue’ Has Stabilized in June Despite Token Sell-Offs

Despite a recent rash of sell-offs, DeFi revenue remained stable over the last week. Learn more about what this trend could mean for the crypto industry here.

5.) Ethereum Gas Fees Reach Lowest Level in 6 Months

The average transaction fee on Ethereum is currently $2.15, the lowest since December 20, 2020. This marks a huge decrease from its largest transaction average of $70, last month.