[ccpw id=”424″]

Protocol of the Week

Set Protocol.

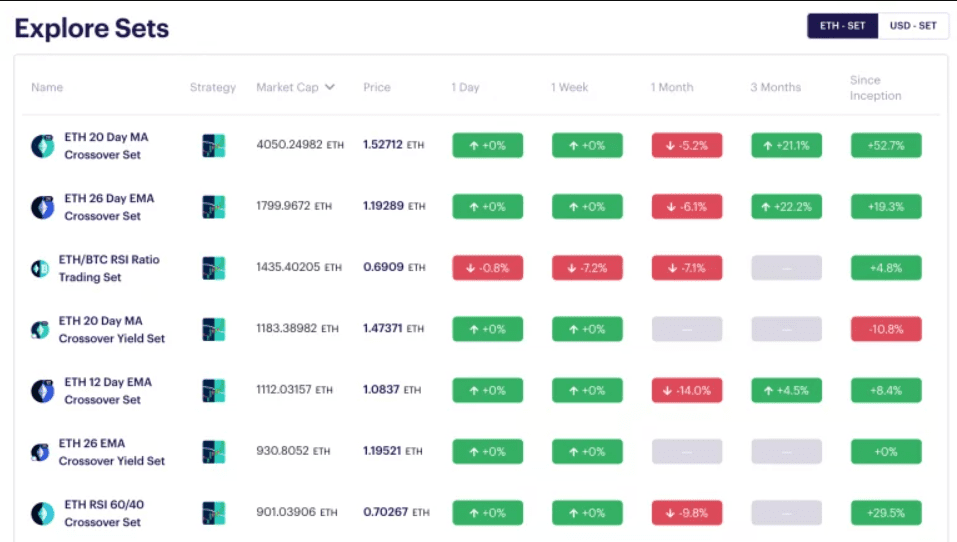

Set Protocol is a platform through which users can create, manage, and obtain baskets of tokenized assets. Through Set, you can use multiple tokens as one. Built on the Ethereum blockchain, Set allows users to bundle together crypto-assets into fully collateralized baskets, represented as ERC20 tokens.

To date, some of the most significant structured products by AUM (asset under management) were built using the Set Protocol, including the DeFi Pulse Index ($DPI) and the ETH 2x Flexible Leverage Index.

DeFi Strategy of the Week

Using Set and TokenSets to create, manage, and trade baskets of tokenized assets.

TokenSets, the first application built on the Set Protocol, allows users and asset managers to create and mange their tokenized assets by interacting with underlying smart contracts. So, each Set you create is itself an ERC20 token that:

- Is listable on exchanges

- Utilizes borderless transactions

- Is smart contract ready

Plus, Set is open, permissonless, and requires no middleman or counterparties. The protocol is designed so that no one can steal the collateral that backs the value of your Set.

Because a Set is 100% collateralized by its underlying components, you can calculate its ‘Net Value Asset’ (NAV) by adding up the value of all underlying component tokens inside the Set. And, by supporting external integrations, Set users can employ any type of asset management strategy, including those operating DEX trades, yield farming, and margin trading.

To begin creating or investing in your own Set, go to TokenSets and create your portfolio. From there TokenSets will help you through a simple, 3-step process.

Yield Farm of the Week

Crop Finance

CROP Finance is an automated, cross-chain, liquidity management, risk-reducing, yield farming platform.

Their primary feature is an automated revenue farming tool that significantly optimizes return on investment and simplifying access to DeFi yield farming. CROP’s platform pools users’ liquidity and moves funds between their portfolio of risk-adjusted yield farming strategies.

Those who’ve attempted to yield farm in the past but got lost or confused, may especially want to check out CROP. The platform automates the yield farming process, so anyone can more easily benefit from the financial rewards of yield farming. CROP acts as a DeFi yield aggregator and gives users a single place to deposit their liquidity.

Simultaneously, CROP distributes gas costs across multiple users, which reduces the costs for each individual. This fee distribution makes using CROP both more accessible and more affordable. CROP’s native token – $CROP – governs the platform.

You can get to farmin’ via CROP, now by connecting your crypto wallet to the platform.

News & Industry Updates

1.) El Salvador’s President Wants Bitcoin as Legal Tender – What it Means

Turning Bitcoin into legal tender would allow debts contracted in Bitcoin to be settled in Bitcoin. Plus, it would allow banks in the country to transact in Bitcoin.

2.) NFT Bubble May Have Popped but Sector Still Primed for Expansion

In the past month, NFT sales and active wallets fell by more than 40 percent. Still, new layer-2 infrastructure is looming as a potential boom for the space.

3.) Curve Picks up Mojo as Battle Breaks Out for its Red-Hot Token

Both Yearn and Convex Finance are making Finances’ CRV token a key part of the foundation in their revenue models.

4.) Uniswap Drafted to Lead DeFi Lobbying Push in Washington

A group of influential Uniswap users have proposed the formation of a DeFi political defense fund to address government action aimed at cryptocurrencies.

5.) Square Inc. to Invest $5M in Blockstream Bitcoin Mining Facility

Square, a crypto-friendly payments company, plans to invest $5M in a solar-powered Bitcoin mining facility for Blockstream Mining.