(April 20 – 27, 2021)

[ccpw id=”424″]

DeFi Strategy of the Week

Enzyme Finance (formerly known as Melon) is an Ethereum-based protocol for decentralized on-chain asset management. It’s a protocol for people or entities to manage their wealth & the wealth of others within a customizable yet safe environment. Enzyme empowers users to establish, manage, and invest in customized on-chain investment vehicles.

Enzyme Finance users can benefit from this protocol in two primary ways – by Depositing or Building.

As a depositor you can find a vault with a proven track record, and break free from the day-to-day hassles while keeping full custody of your assets through Enzyme. Search for and filter strategies by assets, risk and performance, and find one that matches your personal risk profile.

As a builder, Enzyme empowers you to build and scale vaults based on the investment strategies of your choice. Plus, security is Enzyeme’s priority. Their second generation smart contract-enforced platform is thoroughly texted and audited before you make any mainnet deployments.

Additionally, Enzyme recently announced a partnership with Curve pools. Through this partnership, Portfolio Managers in Enzyme Finance can:

- Trade – Curve pools are known for their superior liquidity an minimal slippage. Through Enzyme you can execute large trades in Curve with almost zero slippage and low fees.

- Earn Extra Yield by Providing Liquidity – Adding liquidity to Curve pools allows Vaults to hold and stake the pool LP in their Enzyme vault. This allows you to earn both Curve trading fees, plus any reward tokens associated with that pool (e.g. CRV).

- Auto-Stake – Enzyme contracts automatically stake LP tokens for users to ensure you’re always getting the best yield.

- Claim Rewards & Re-Deposit in 1-Click – Claiming rewards and re-investing them into the underlying Curve Pool is now possible in one-click. Compound your returns on auto-pilot!

- Claim Rewards & Swap in 1-Click – You can now user the yield you generate via Curve to accumulate other assets, essentially at zero cost.

Read more about Enzyme here and learn about their partnership with Curve here.

Yield Farm of the Week

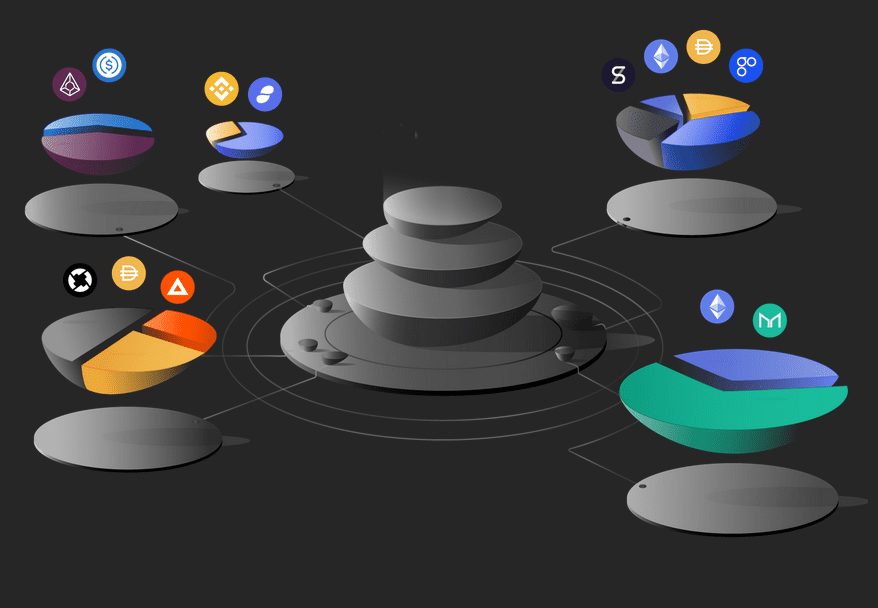

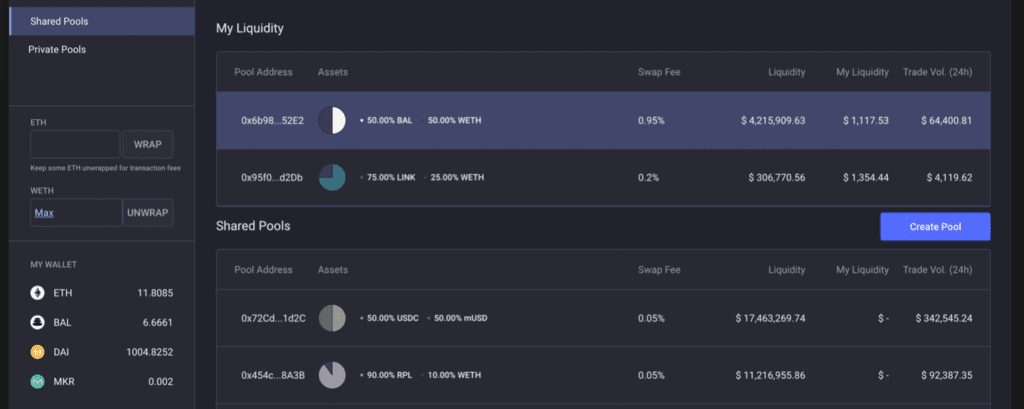

Balancer is an asset management platform that acts as an automated portfolio manager, liquidity provider, and price sensor. This platform turns the concept of an index fund on its head. Instead of paying fees to portfolio managers to rebalance your portfolio, you collect fees from traders, who rebalance your portfolio by following arbitrage opportunities.

Balancer is an example of an Automated Market Marker (AMM). AMMs have been around in some form, since it was possible to automate trades. Essentially, AMMs are automated agents, controlled by an algorithm, that define rules for matching buyers and sellers to facilitate trades.

Key attributes of Balancer include:

- A native exchange that uses smart order routing to mitigate price slippage across different trading pairs.

- Swap fees earn from portfolio rebalances, DEX trading, and arbitrage opportunities.

- The ability to create a Balancer Pool with an asset makeup and fees of your choosing.

- Automatically rebalanced liquidity pools that can be entered using one token.

- Automatically rebalanced liquidity pools that support up to 8 different tokens and can be weighted by percentage.

To align token holders and protocol stakeholders, Balancer has implement a native token – the Balancer Protocol Gorvernance Token (BAL). Users can earn BAL through Liquidity Mining in Balancer.

Learn more about the BAL token here.

News & Industry Updates

1. K.C. Chiefs Tight End to Convert Entire NFL Salary into Bitcoin.

Earlier this week, top NFL prospect Trevor Lawrence, signed a mult-year, multi-million-dollar endorsement deal with Blockfolio. Now, Kansas City Chief’s player, Sean Culkin, has announced he will take his entire 2021 base salary – $920,000 – in Bitcoin.

2. Wyoming Becomes First State to Address Legal Treatment of DAOs.

Last Wednesday, in the state’s Bid to become the “Deleware of digital assets,” Wyoming signed bill SF38 into law. This law makes Wyoming the first state in the U.S. to address the legal treatment of decentralized autonomous organizations (DAOs).

3. PayPal CEO: Demand for Crypto Much Higher Than Expected.

PayPayl CEO Dan Schulman, while speaking to TIME Magazine, revealed demand for cryptocurrencies on the platform has been even higher than anticipated. The CEO also noted the COVID-19 pandemic was likely a significant accelerator for the digitization of payments everywhere.

4. Tracking Bitcoin’s Carbon Footprint.

A recent academic paper attempting to track the carbon footprint of Bitcoin mining has sparked questions about just how difficult it is to accurately measure Bitcoin’s carbon dioxide emissions.

5. Binance to Launch Apple, Microsoft, and more Stock Tokens.

Binance, one of the top crypto asset exchanges, announced it will list three new stock tokens during the coming week. Tokenized stock pairings for MicroStrategy, Apple, and Microsoft will all become available over the course of next week.