[ccpw id=”424″]

DeFi Strategy of the Week

Curve Finance is a decentralized finance exchange (DEX), launched in January 2020, that focuses on assets that are similar in price. The platform allows you to trade between stablecoins with low fees and low slippage.

Via Curve Finance, you get the best exchange rates and ensure you’re always using a decentralized platform. Essentially, Curve allows users to take one stablecoin and diversify their assets across multiple stablecoins, yielding interest from them all.

Where Uniswap focuses on maximizing available liquidity, Curve’s algorithm emphasizes minimizing slippage by accommodating new varieties of bonding curves. Plus, Curve only charges a trading fee once unlike Uniswap, which charges twice. So, Curve traders save more!

And Curve is useful for swapping other assets too, like tokenized versions of a coin. For example, Curve is great for sapping between different tokenized versions of Bitcoin, like WBTC or sBTC. Curve users can trade between

In addition to these efficient swaps, Curve Finance is useful for liquidity providers who want to earn a return on top of their interest earned, without having to hold more volatile assets.

Curve rewards users that take part in their liquidity pools, with their governance token – CRV. All those who participate in Curve pools will retroactively receive CRV tokens.

To get started, you’ll need a web3 wallet like MetaMask. Once you have your assets in such a wallet, you can start trading or depositing DAI, USDT, USDC, and TUSD.

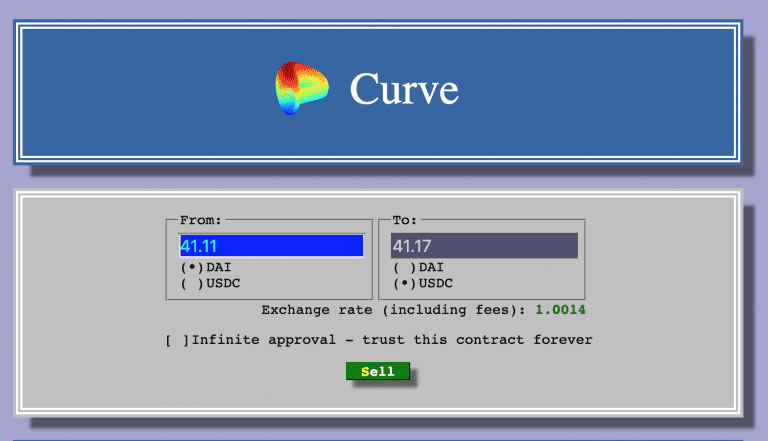

To trade, go to the “Buy and Sell” page.

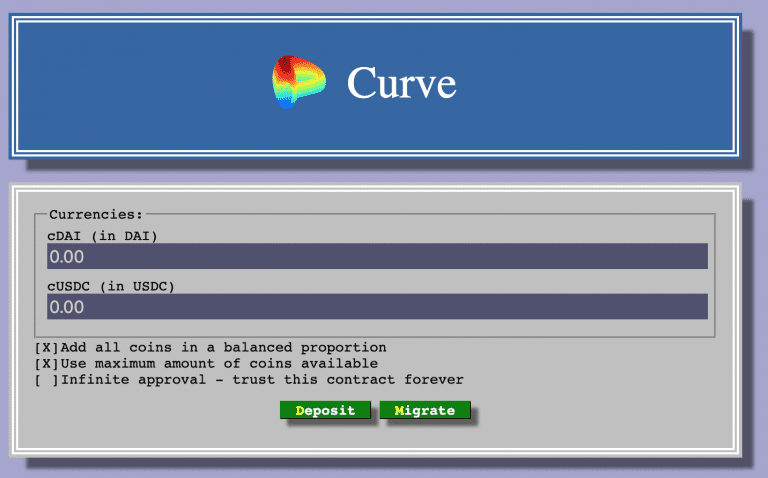

To provide liquidity, go to the “Deposit” page.

Visit Curve to learn more, or watch a video of how Curve works here.

Yield Farm of the Week

Vesper Finance – is a platform of DeFi products designed for ease-of-use, longevity, and scale. It is governed by its native token, VSP. The three pillars that form the foundation of Vesper include:

1. Vesper Products – Yield Farming through Grow Pools.

2. Vesper Token – VSP.

3. Vesper Community – Building a community that sustains and grows the product portfolio, facilitates progressive decentralization, and enables users to build new products.

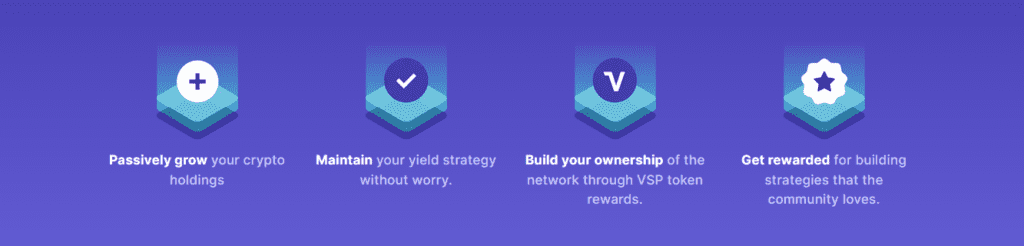

Via these pillars, Vesper users can passively grow your crypto holdings, maintain your yield strategy without worry, build your ownership of the network, and receive rewards for building strategies that benefit the whole community.

Through Vesper, you can:

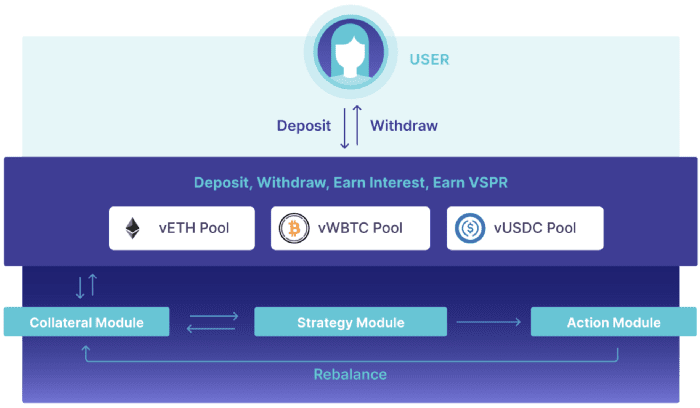

One of the main features of Vesper is the Vesper Grow Pools. Vesper Grow Pools are algorithmic DeFi lending strategies. They pool capital from a group of users and deploy it to generate interest across various DeFi products. Any accrued interest gained from these pools is used to buy back the pool’s deposit asset and award it as interest to participants.

Basically, once deposited in Vesper, your assets are pooled and automatically deployed to other DeFi protocols based on your desired strategy and risk tolerance. The objective of any Vesper deposit is to help you earn interest in your chosen asset. So, for example, if you deposit ETH, you’ll earn ETH interest.

And as previously mentioned, Vesper uses its native token, VSP, to incentivize participation, facilitate governance, and catalyze user contributions. Users can earn VSP tokens by: participating in Vesper pools, providing liquidity, and staking.

Read more about Vesper and how they work here. Or watch a video of how the platform works here.

DeFi News

1. DeFi Protocols are Bringing in Record Monthly Revenue

2. A Bitcoin Rally in the Near Future?

3. Rakuten Lets Users Shop with Crypto

4. A $5.7 Million Crypto Heist

5. Native Tokens of NFTs Increasing in Value

Alpha Leaks

If you’ve been paying attention to NFTs, or non-fungible tokens, you know they’ve been in the news a lot lately. Created by Dapper Labs, NBA Top Shot allows users to collect, store, and swap a single, digital NFT in the form of a player’s highlight. In Top Shot, these digital highlights replace physical trading cards.

Using Flow Blockchain, Top Shot mints NBA highlights and puts them into packs. Like physical card packs, these low-cost packs contain randomly placed moments from various players like up-and-coming rookies, to highlights from major stars. Once unpacked, you can resell or trade individual moments on the marketplace.

But, if you want to get in on the fun, act quickly. With over 120K active users, NBA Top Shot has already surpassed Uniswap and PancakeSwap as one of the most active decentralized applications!