Protocol of the Week

Warp Finance

Warp’s primary objective is to create an environment for crypto holders to invest unused liquidity provider (LP) tokens as collateral for lending. Its mission is to provide new lending opportunities to increase liquidity and free your assets.

Through Warp, users can deposit LP tokens and receive stablecoin loans in exchange. Plus, these LP tokens continue to earn via Uniswap’s rewards. So, you reduce your effective interest rate paid by lending LP tokens and receiving these trade fees from Uniswap.

$WARP – Warp Finance’s native token – is used to govern the protocol.

DeFi Strategy of the Week

Lending or borrowing through Warp Finance.

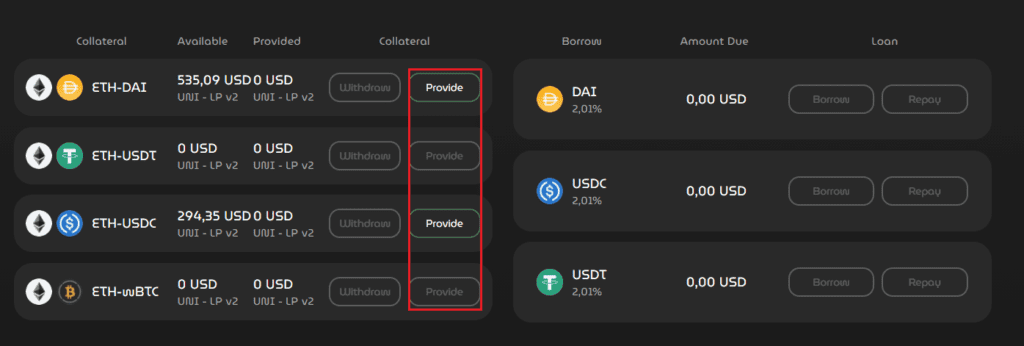

There are two primary methods to profit via Warp Finance: either as a borrower or a lender. As a borrower on Warp, you can deposit LP tokens generated from four Uniswap pairs:

- WBTC-ETH

- ETH-USDC

- ETH-USDT

- ETH-DAI

These pairs are deposited at 150% over-collateralization, meaning a borrower must deposit at least 1.5x the value of their desired loan. After you deposit your LP tokens, you receive a loan of DAI, USDC, or USDT. The interest rate of this loan will fluctuate based on the availability of your selected stablecoin within the liquidity pool.

Keep in mind; your deposited LP tokens will earn 0.3% from Uniswap per trade made in the respective liquidity pool. Once you repay your loan, you may withdraw your collateral.

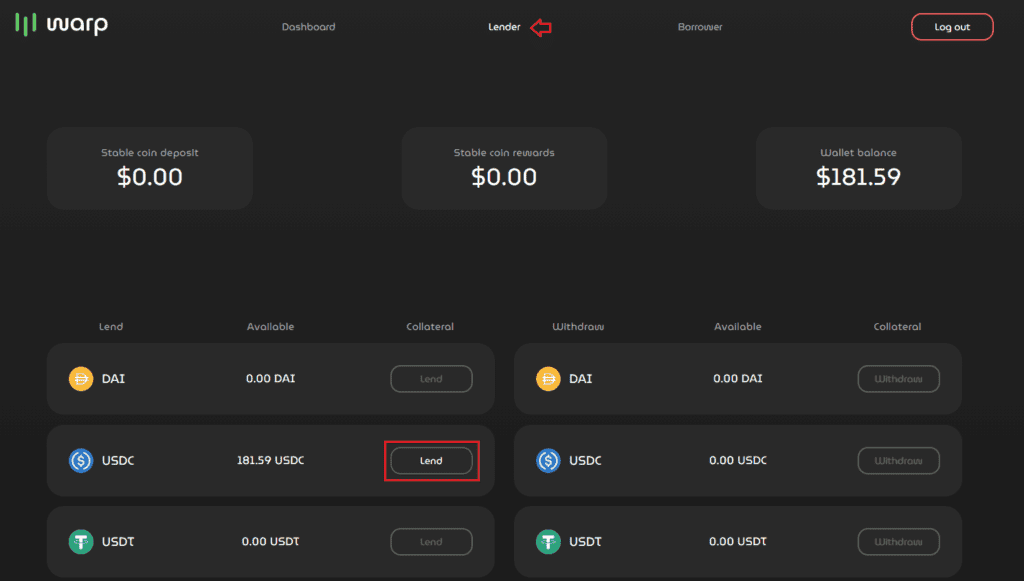

As a lender, you start by suppling either DAI, USDC, or USDT on Warp. In return, you’ll receive wDAI, wUSDC, or wUSDT. Each of these is an interest-earning token that indicates a deposit into Warp. Upon withdrawal, you get back your stablecoin, plus the interest earned.

Here’s an in-depth guide on how to use Warp Finance.

Yield Farm of the Week

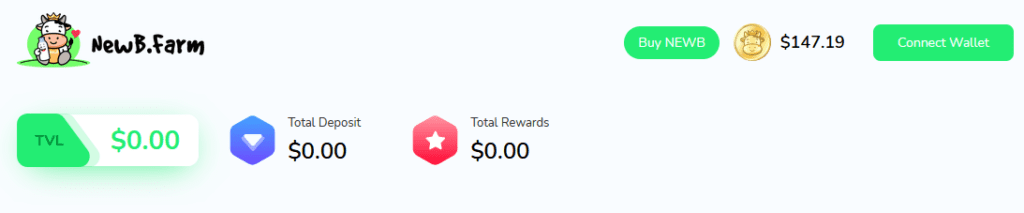

Simple yield farming with NewB.Farm.

NewB.Farm is a relative newcomer to the yield farming game. The platform, built on the Binance Smart Chain (BSC), provides a user-friendly yield farming opportunity and is easy to use for anyone without technical knowledge of the DeFi universe.

The protocol uses yield optimizers and other mechanisms to ensure every user receives the best yields for their investment. Compared to traditional banks, NewB.Farm provides far more significant gains – up to 71% annual return. Plus, as NewB.Farm is built for entry-level users; it’s easy to stake your assets.

To start earning on NewB.Farm, enter the farm, connect your wallet, and stake on one of the supported pools.

News & Industry Updates

1.) Swedish Financial Regulator: Bitcoin, Ethereum Mining Threatens Paris Climate Agreement

Sweden’s financial supervisory authority has called for a ban on crypto mining, calling cryptocurrencies a threat to the climate.

2.) Balancing Crypto’s Carbon Footprint with its Social Utility is Key to Sustainable Finance

As cryptocurrencies grow in popularity and overall value, it’s becoming more necessary than ever that the industry builds a sustainable future.

3.) U.S. Stablecoin Report Gets Mixed Reviews from Crypto Industry

This week’s President’s Working Group (PWG) report on Financial Markets received praise from practitioners but attacks from advocates.

4.) 5 Reasons Why Blockchain-Based Gaming Economies are the Future

Axie Infinity is showing the gaming industry just a sliver of what blockchain-based gaming can achieve, and the industry is set to explode shortly.

5.) Ethereum’s Gas Fees Plummet While Price’s Soar

The past week has seen Ethereum’s gas fees and trading volumes decrease while the network’s hash rate surges.