Note: This DeFi quick start guide is for using Ethereum only. Binance Smart Chain and Polygon DeFi guides are coming soon.

Step 1: Use a Crypto Exchange to Get Ethereum

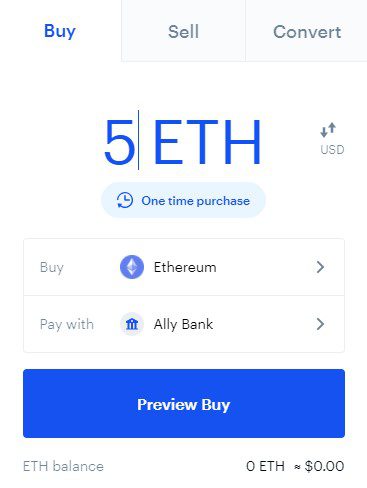

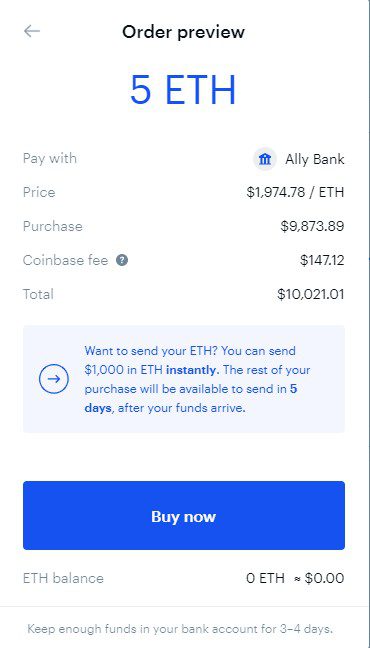

Our favorite exchange for buying Ethereum is Coinbase. Sign up for an account and link your desired payment method.

Note: Connecting your bank account can take up to 2 days to get verified.

Next, click "Buy/Sell" at the top right. You want to purchase Ethereum.

Remember the first rule of DeFi: Only buy as much as you can afford to lose.

Note: ETH is required to perform transactions on the Ethereum Network. You will not be able to interact with dApps and/or DeFi protocols without it.

Step 2: Setting Up Your Wallet

Our wallet of choice is MetaMask. Download the browser extension here.

Once you have downloaded the extension you will be brought to this screen. Click the button on the right, "Create a Wallet"

To set up a new wallet you need a "Secret Backup Phrase". MetaMask generates this for you. This phrase is the only way to recover your wallet if you forget your password! This is very important so make sure to put this somewhere safe.

Once you have your wallet set up you will be brought to this page below. Your ETH address is the string of characters under "Account 1". It will always start with 0x. If you hover over it, you can copy it to the clipboard. This is important to transfer funds from Coinbase over to your new wallet.

Note: Ethereum is an open ledger. If you don't want people to know your wallet balance or transaction history do not share this address publicly.

Some people will set up multiple wallets; one for private use and

one for public use.

Step 3: Transfer Funds From Coinbase to Your MetaMask Wallet

Back on Coinbase, click the button at the top right that says, "Send/Receive".

Once you see the popup below, paste in your ETH address from MetaMask. A note is not necessary.

After a few minutes you'll see your ETH show up in MetaMask.

Note: Sometimes the Ethereum network can get congested. Don't be alarmed if it takes a bit. However, the majority of transactions are completed

in under 10 minutes.

Congratulations, you have officially become decentralized!

Now that you have completed the first step in DeFi what would you like to do:

Click a box to scroll down to the appropriate section

DEX Trading

Uniswap

"The Uniswap protocol empowers developers, liquidity providers and traders to participate in a financial marketplace that is open and accessible to all."

33k+

Token Pairs

$1.6B

24H Volume

$8B

Total Liquidity

SushiSwap

"Swap, earn, stack yields, lend, borrow, leverage all on one decentralized, community driven platform. Welcome home to DeFi."

958

Token Pairs

$51.53B

Total Volume

$4.17B

Total Liquidity

Borrowing/Lending

Compound Finance

"Compound is an algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications."

3%

Average Deposit APY

10

Markets

$15.1B

Total Liquidity

Aave

"Aave is an open source and non-custodial liquidity protocol for earning interest on deposits and borrowing assets."

5%

Average Deposit APY

24

Markets

$7.1B

Total Liquidity

Provide Liquidity

Uniswap

"The Uniswap protocol empowers developers, liquidity providers and traders to participate in a financial marketplace that is open and accessible to all."

SushiSwap

"Swap, earn, stack yields, lend, borrow, leverage all on one decentralized, community driven platform. Welcome home to DeFi."

Vault Staking

Yearn Finance

"Capital pools that automatically generate yield based on opportunities present in the market. Vaults benefit users by socializing gas costs, automating the yield generation and rebalancing process, and automatically shifting capital as opportunities arise. End users also do not need to have a proficient knowledge of the underlying protocols involved or DeFi, thus the Vaults represent a passive-investing strategy."

Asset/Portfolio Management

Zapper

"The Zapper API provides some of the most robust Defi related data, everything from liquidity and prices on different AMMs to complex Defi protocol balances all in one convenient place. In addition, the API also supports bridging between different networks as well as formatted Zap transaction endpoints."

$2.4B+

Total Volume

500k+

Users

54

Platforms Supported

Yield Farming

Harvest Finance

"Harvest is an international cooperative of humble farmers pooling resources together in order to earn DeFi yields. When farmers deposit, Harvest automatically farms the highest yields with these deposits using the latest farming techniques."

$524M+

In Deposits

$7.6M+

Monthly Profits to Users

2

Blockchains Supported